If you are reviewing your Medicare coverage for 2026, you likely have one big question: “What about my teeth, eyes, and ears?”

It is the most common surprise for seniors. You work hard, you get your red, white, and blue Medicare card, and you assume you are fully covered. Then you go for a routine cleaning or an eye exam and get hit with a full bill.

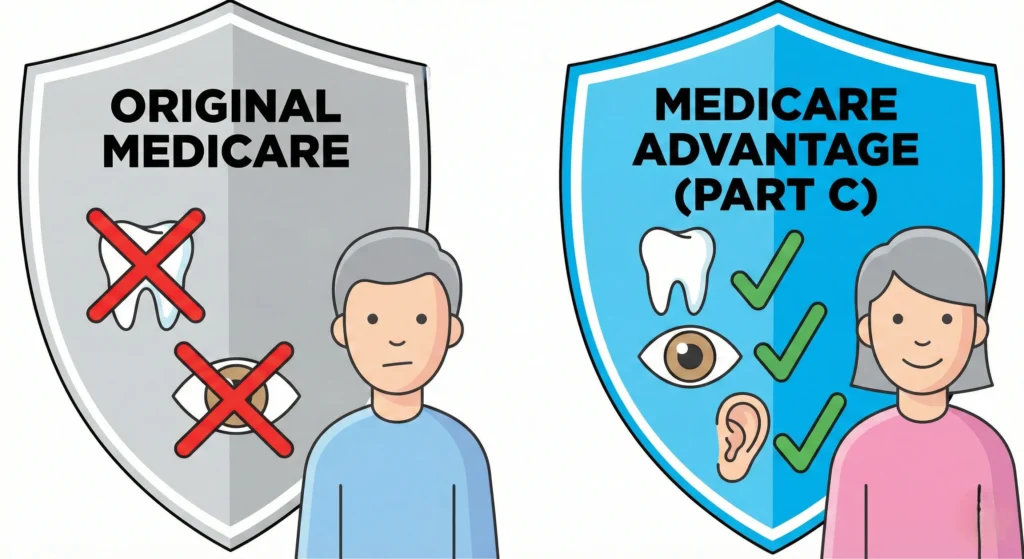

The short answer? Original Medicare generally does not cover routine dental, vision, or hearing care.

However, there are ways to get this coverage. In this guide, we will break down exactly what is covered, what isn’t, and how to find the right plan for your needs in 2026.

The Hard Truth: What Original Medicare Doesn’t Cover

When we talk about “Original Medicare” (Part A and Part B), the rules for 2026 remain strict regarding routine care. The government focuses on “medically necessary” treatments for illness and injury, not preventative maintenance for your teeth and eyes.

1. Dental Coverage in 2026

- Not Covered: Routine cleanings, exams, fillings, dentures, tooth extractions, and implants are 100% your responsibility under Original Medicare.

- The Rare Exceptions: Medicare Part A (Hospital) may cover inpatient dental services if they are required for a more complex medical procedure. For example, if you need a heart valve replacement or an organ transplant, Medicare may cover a dental exam or extraction beforehand to prevent infection. They may also cover jaw reconstruction after an accidental injury.

2. Vision Coverage in 2026

- Not Covered: Routine eye exams for glasses (refraction), the eyeglasses themselves, and contact lenses.

- The Rare Exceptions: Medicare Part B will cover annual eye exams if you have diabetes (checking for diabetic retinopathy) or are at high risk for glaucoma. They also cover cataract surgery and one pair of basic glasses or contact lenses after the surgery.

3. Hearing Coverage in 2026

- Not Covered: Routine hearing exams and hearing aids.

- The Rare Exceptions: Diagnostic hearing and balance exams are covered only if your doctor orders them to treat a medical condition (like sudden hearing loss or vertigo).

Will Medicare Cover Dental in 2026 for Seniors?

As of 2026, there has been no new legislation passed to add routine dental coverage to Original Medicare. While there are often proposals in Washington to expand benefits, for this year, you must rely on private insurance or Medicare Advantage for these services.

What are the four things Medicare doesn’t cover?

If you are budgeting for 2026, keep these four major exclusions in mind:

- Routine Dental (Cleanings & Dentures)

- Routine Vision (Exams & Glasses)

- Hearing Aids (and fitting exams)

- Long-Term Custodial Care (Nursing home care for daily living help, like bathing or dressing)

How to Get Coverage: Your Options for 2026

Since Original Medicare won’t pay for your glasses or fillings, you generally have two paths to get coverage.

Option 1: Medicare Advantage (Part C)

This is the most popular way seniors get these benefits. Medicare Advantage plans are private insurance plans (like Humana, UnitedHealthcare, or Aetna) that bundle your Part A and Part B benefits together.

- Is there a Medicare plan that covers dental and vision? Yes. In 2026, approximately 97% to 99% of Medicare Advantage plans offer some level of dental, vision, and hearing benefits.

- What to look for: These plans often have $0 premiums, but you need to check the “allowance.” Some plans give you $1,000 a year for dental; others might give $3,000.

- Which Medicare Advantage plan has the best dental coverage in 2026? There is no single “best” plan because they vary by zip code. You must look for a plan that covers “comprehensive dental” (crowns, dentures) rather than just “preventative dental” (cleanings).

Option 2: Stand-Alone Private Insurance

If you prefer to stay on Original Medicare (perhaps because you want to see any doctor nationwide), you can purchase a separate Dental, Vision, and Hearing (DVH) policy. These usually cost between $25 and $50 per month.

2026 Medicare Cost Updates: What You Need to Know

Your wallet will feel a slight difference this year. Here are the confirmed numbers for 2026.

How much will be deducted for Medicare in 2026?

The standard Part B premium for 2026 is $202.90 per month. This is typically deducted automatically from your Social Security check.

What will be the Medicare deductible in 2026?

Before Part B starts paying 80% of your bills, you must meet the annual deductible. For 2026, the Part B deductible is $283 (an increase from previous years).

What is the new Medicare rule for 2026 for seniors?

The biggest change involves prescription drugs. Thanks to the Inflation Reduction Act, the Part D out-of-pocket cap for 2026 is $2,100. Once your total out-of-pocket spending on covered drugs hits this amount, you won’t pay a cent more for your medications for the rest of the year.

FAQ: Quick Answers for 2026

Do you get a free pair of glasses with Medicare?

With Original Medicare? No. With a Medicare Advantage plan? Usually, yes. Most plans provide a yearly allowance (e.g., $150–$200) to buy frames or contacts.

Are Medicare dental plans worth it?

If you need major work (like a root canal or dentures), yes. If you have healthy teeth and only need two cleanings a year, sometimes paying out-of-pocket is cheaper than paying monthly premiums. Do the math before you sign up!

What is the best Medicare prescription plan for 2026?

The “best” plan is the one that covers your specific medications. Use the plan finder tool on Medicare.gov. Enter your exact prescriptions to see which Part D plan results in the lowest total cost for you.

Who has the best dental coverage for Medicare?

Major carriers like UnitedHealthcare, Humana, and Aetna generally offer the most robust dental packages in their Advantage plans, often covering exams, X-rays, and cleanings at $0 copay.

The Bottom Line

While we all wish Original Medicare covered everything from head to toe, the reality in 2026 is that you need to be proactive. If you want to protect your smile and your sight, look into a Medicare Advantage plan or a stand-alone dental/vision policy.

Disclaimer: I am an AI assistant, not a licensed insurance agent. Medicare costs and plan availability change annually and vary by location. Always verify details at Medicare.gov or consult a licensed local broker.