Let’s be real: Medicare is complicated. But if you know where to look, there are seven free benefits hiding in plain sight perks that could save you literally thousands of dollars every year. Most seniors never claim them.

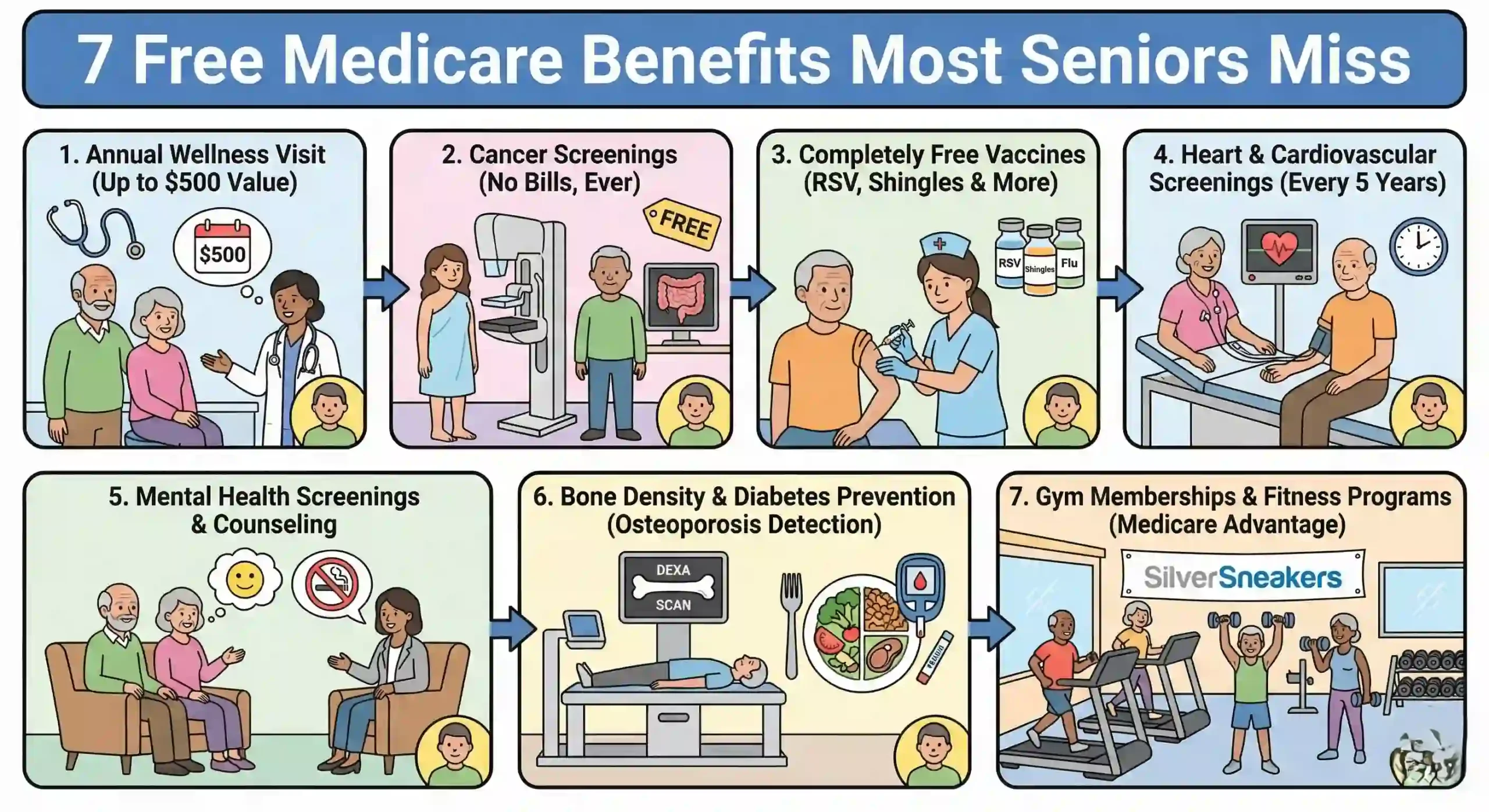

1. Your Annual Wellness Visit (Completely Free)

Here’s something most Medicare beneficiaries skip: the free Annual Wellness Visit. Once a year for zero dollars you can schedule a visit with your doctor to talk about staying healthy, not treating illness. It’s like getting paid to think ahead.

What’s included:

- Vital signs check (height, weight, blood pressure)

- Medical & family history review — Your doctor asks questions about your past, your relatives’ health, what keeps you up at night

- Medication review — He flags drugs that interact badly, doses that don’t make sense

- Health risk assessment — A personalized prevention plan. A real one, on paper

- Screening schedule — The doctor lays out what tests you need over the next 5-10 years

The catch (there always is one):

You must have been enrolled in Medicare Part B for more than 12 months. If you’re brand new to Medicare, you get a “Welcome to Medicare” exam in your first year instead. Same cost: zero dollars.

Key data: Only 31% of eligible Medicare beneficiaries actually use this benefit. You’re literally leaving free preventive care on the table. Most annual physicals run $150–$300 out of pocket if you have to pay. This one? Free.

2. Free Cancer Screenings (Colorectal, Breast, Cervical)

Here’s where Medicare gets serious about keeping you alive. Cancer screenings catch disease early, when treatment works. And Medicare doesn’t charge you a dime.

Colorectal cancer screening:

- Colonoscopy (recommended every 10 years for people 50+): $0 cost

- Flexible sigmoidoscopy (every 5 years): $0 cost

- Fecal occult blood test (annually): $0 cost

Breast cancer screening:

- Mammogram (annually for women 65+): Covered at 100%

Cervical and vaginal cancer screening:

- Pap test & pelvic exam (every 3 years, or 5 years if using HPV testing): Free

Why this matters: Colorectal cancer is the second-leading cancer killer in the U.S. Early detection raises your 5-year survival rate from 14% (late stage) to 91% (early stage).

Key data: The U.S. Preventive Services Task Force recommends these screenings with an “A” rating, meaning Medicare covers them 100%. No deductible. No coinsurance. But you must use a provider who accepts Medicare assignment. Ask your doctor.

3. Free Preventive Vaccines (Flu, Pneumonia, Shingles, RSV)

Vaccines aren’t just for kids. Every year, flu kills 12,000–61,000 Americans. Pneumonia hospitalizes tens of thousands of seniors. And shingles causes unbearable pain in 1 in 3 people over 50. Medicare covers all of this. Free.

What’s included:

- Flu shot (annual): $0

- Pneumococcal vaccine (once or twice, depending on age): $0

- Shingles vaccine (Shingrix) (2-dose series): $0

- RSV vaccine (new in 2024, one dose for people 60+): $0

- Hepatitis B vaccine (3-dose series if you’re 19+): $0

- COVID-19 vaccine (updated annually): $0

- Tdap booster (if you haven’t had one since age 19): $0

The hidden cost no one talks about:

If you get vaccinated at a pharmacy (Walgreens, CVS) instead of your doctor’s office, you might get billed differently. Call ahead. Ask: “Will Medicare cover this with no cost-sharing?” Your doctor’s office is your safest bet.

Key data: Just the shingles vaccine alone costs $200–$400 out of pocket without Medicare. The flu shot? $30–$60. Over 10 years, that’s $2,300+ you’re not paying. And you’re not getting shingles (a disease so painful some patients consider it a sign of serious illness until they realize it’s “just” shingles).

4. Free Cardiovascular & Diabetes Screenings

Heart disease kills 1 in 5 Americans. Diabetes affects 11% of seniors. But if you catch them early, you can prevent the damage. Medicare covers the screening. You don’t pay.

What’s free:

- Abdominal aortic aneurysm (AAA) screening (one-time ultrasound for men 65-75 who’ve ever smoked): $0

- Cardiovascular disease (CVD) screening (blood test, EKG, or imaging): $0, if you have risk factors

- Diabetes screening & counseling (fasting glucose test, A1C test): $0

- Behavioral counseling for heart disease & diabetes (up to 8 sessions per year): $0

- Cholesterol screening (lipid panel): $0

These aren’t fancy tests. They’re bread-and-butter early warnings. Catch high cholesterol at 70, and you avoid a heart attack at 75. Catch pre-diabetes now, and you avoid insulin injections later.

Key data: An advanced cardiac imaging test (like a coronary calcium scan) costs $100–$400 out of pocket. Heart medication costs $20–$200/month long-term. Preventing a heart attack? Priceless. And this part: Medicare covers it.

5. Free Mental Health & Counseling Services

Here’s one nobody talks about: Your brain matters. Depression, anxiety, and cognitive decline hit seniors hard. And you can get help for free.

What’s covered:

- Depression screening (annual, during your wellness visit): $0

- Smoking cessation counseling (up to 8 face-to-face visits per year): $0

- Behavioral therapy for heart disease or diabetes (up to 8 sessions per year): $0

- Substance abuse & alcohol misuse counseling (screening + referral): $0

- Obesity counseling (if your BMI is 30 or higher, up to 8 sessions): $0

Here’s the uncomfortable truth: 1 in 7 seniors has depression. Many don’t report it. They think it’s “just part of getting old.” But untreated depression makes every chronic disease worse, increases hospitalization, and wrecks quality of life.

Key data: A therapy session runs $100–$250 without insurance. Eight sessions a year = $800–$2,000 out of pocket. Medicare covers this at zero cost to you. The catch: You need a provider who accepts Medicare assignment. Ask. Most do.

6. Medicare Savings Programs (MSPs) Save $2,400+ Yearly

Here’s where most seniors leave thousands on the table: They don’t know about Medicare Savings Programs (MSPs). If you have low income and limited assets, your state can pay your Medicare premiums and deductibles. Outright. For free.

Who qualifies:

Income limits change yearly, but roughly:

- Single person: Income below $1,585/month (2025) + assets below $9,660

- Married couple: Income below $2,135/month (2025) + assets below $14,470

If that’s you or close keep reading.

What you can get:

- Qualified Medicare Beneficiary (QMB) program — Pays your Part A & Part B premiums, deductibles, and coinsurance. That’s $202.90/month in Part B premium alone. Over a year: $2,435.

- Specified Low-Income Medicare Beneficiary (SLMB) program — Pays just your Part B premium. Still $2,435/year.

- Automatic Extra Help on Part D drugs — If you qualify for an MSP, you automatically get “Extra Help” paying for prescriptions. In 2025, that caps your drug copay at $4.90 for generic drugs and $12.15 for brand names. Annual savings: up to $6,200.

The application mystery:

You don’t apply through Medicare. You apply through your state. Call your state Medicaid office or visit Medicare.gov/savings-programs to find the contact. Takes 10 minutes to apply. Saves thousands.

Key data: 8.8 million seniors are eligible for MSPs. Only 4.6 million are enrolled. That means 4.2 million people are paying premiums and deductibles they don’t have to pay. You might be one of them.

7. Medicare Advantage Supplemental Benefits (Dental, Vision, Hearing, Fitness)

Original Medicare doesn’t cover dental, vision, or hearing. But 98% of Medicare Advantage plans do. And millions of seniors don’t realize they can switch to a plan that covers these with little or no additional premium.

What’s typically included in MA plans:

- Dental benefits (cleanings, fillings, crowns): Covered by 98% of plans

- Vision care (eye exams, glasses, contacts): Covered by 99% of plans

- Hearing aids & exams (some plans cover up to $2,000+): Covered by 95% of plans

- Fitness memberships (SilverSneakers, Renew Active, etc.): Covered by 94% of plans

- Over-the-counter allowance ($50–$200/year for vitamins, bandages, pain relievers): Covered by 80%+ of plans

- Transportation to doctor visits (non-emergency): Many plans offer free rides

- Meal delivery (for seniors with chronic illness): Growing number of plans

- Caregiver support & home safety modifications: Select plans

The catch (there’s always a catch):

Medicare Advantage plans have networks. You must see doctors in-network, or you pay. And the plan might cap services (e.g., “two cleanings per year” for dental). But for most seniors, it’s still cheaper than Original Medicare + Medigap.

Key data: Hearing aids alone cost $2,000–$6,000 per pair (you need two). Dental work? Root canals run $500–$1,500. Eye exams and glasses? $200–$400 yearly. If your MA plan covers even one of these at no extra premium, you’re coming out ahead. 76% of Medicare Advantage enrollees pay zero additional premium beyond the Part B premium ($185 in 2025).

FREQUENTLY ASKED QUESTIONS

Q1: Do I have to pay anything for these free Medicare benefits?

A: No but with one important condition: Your doctor must accept Medicare assignment. This means they accept Medicare’s approved amount as full payment and won’t bill you extra. When you call to schedule an appointment for a preventive service, ask: “Do you accept Medicare assignment?” If yes, you’re covered. If no, find another doctor. Also, if your provider adds services beyond what Medicare covers (e.g., you ask for extra bloodwork), you may be billed for that add-on.

Q2: I’m newly enrolled in Medicare. Can I get these benefits right away?

A: Most yes, some no. Preventive services like cancer screenings, vaccines, and cardiovascular checks are available immediately. But the Annual Wellness Visit (benefit #1) must wait. You get the “Welcome to Medicare” exam in your first 12 months, then the Annual Wellness Visit kicks in after that. Medicare Savings Programs also have no waiting period apply now if your income qualifies.

Q3: What if I have a Medicare Advantage plan instead of Original Medicare?

A: Good news: You get the same preventive services (wellness visits, cancer screenings, vaccines) at zero cost—as long as you see in-network providers. And you might get even more (dental, vision, hearing, fitness) as supplemental benefits. The key: Stay in-network. See an out-of-network doctor, and you might get charged.

Q4: How do I actually claim these benefits? Do I need to do anything special?

A: For most benefits (preventive visits, screenings, vaccines), just schedule with your doctor and mention you want the free Medicare-covered service. Your doctor’s office handles the billing to Medicare. No paperwork from you. For Medicare Savings Programs (benefit #6), you do need to apply through your state Medicaid office it’s not automatic. Find your state at Medicare.gov/savings-programs or call 1-800-MEDICARE for the phone number.

Q5: Are these benefits guaranteed to stay free, or could Medicare cut them?

A: The Affordable Care Act (ACA) mandated that Medicare cover preventive services recommended by the U.S. Preventive Services Task Force with an “A” or “B” rating at zero cost. That law hasn’t changed. Medicare Savings Programs are also federal law. So yes, they’re locked in. However, Medicare does periodically review which services qualify (e.g., a new vaccine might be added). Always check Medicare.gov or call 1-800-MEDICARE if you’re unsure whether a specific service is free.