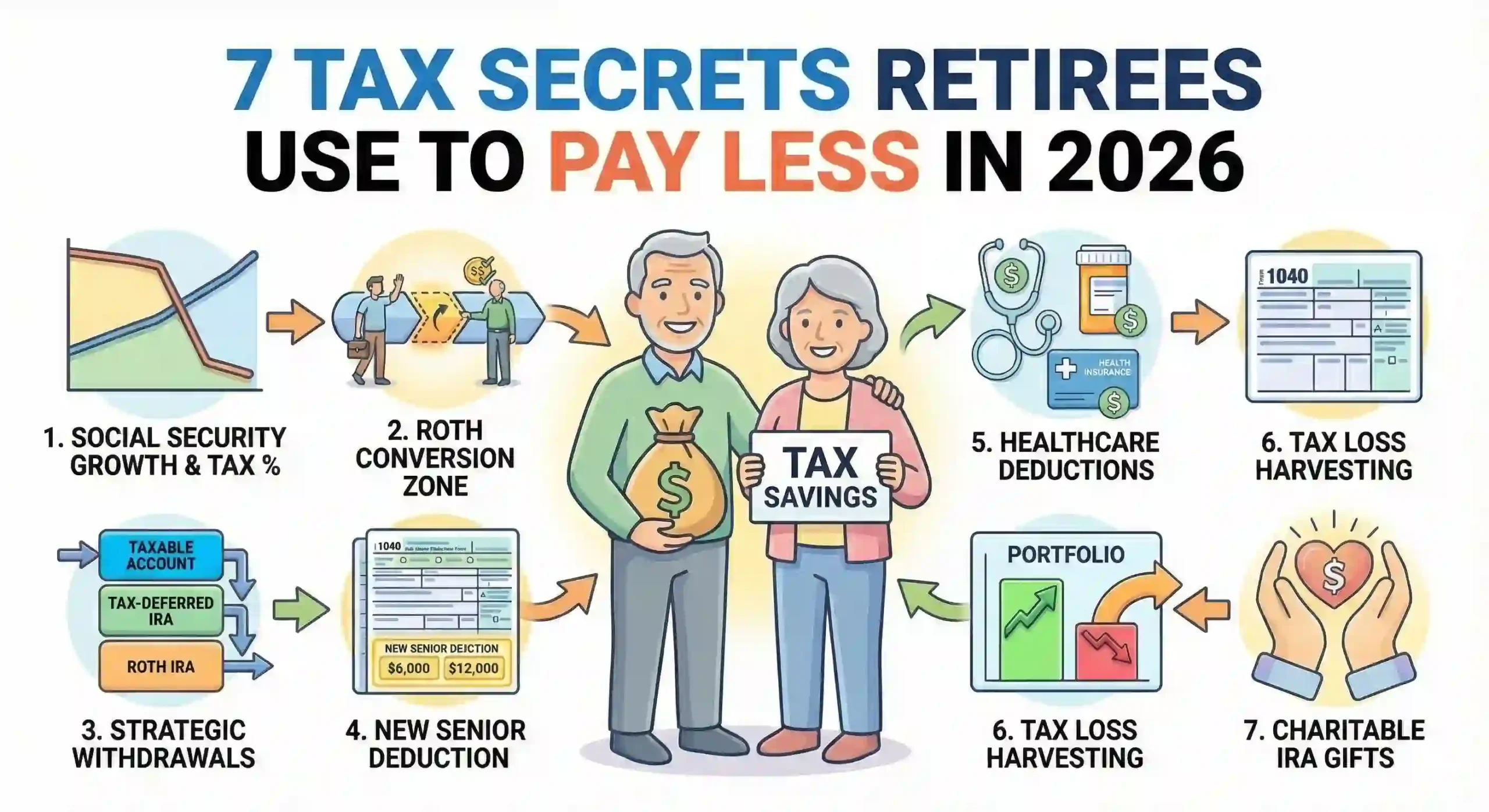

Retirement taxes look simple on the surface you stop working, get Social Security, live off savings. But the strategy? That’s where the complexity hides.

The difference between paying 18% tax on your retirement income and paying 38% often comes down to decisions made years before you retire. The retirees paying the least in taxes aren’t necessarily the ones with the smallest incomes they’re the ones with the best strategies.

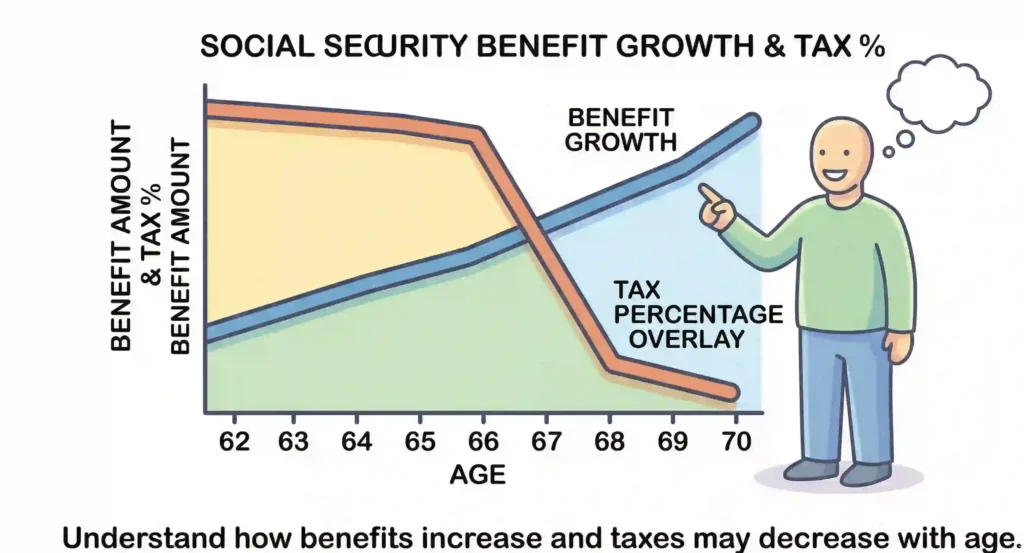

1. Delay Social Security to Cut Taxes by 41-85%

This Social Security strategy is not true for everyone, but it is true for the vast majority of everyone. The longer you wait to start Social Security, the bigger your monthly paycheck (and lifetime payout) will be.

Here’s the tax secret nobody talks about: Delaying Social Security doesn’t just increase your monthly check by 8% per year. It dramatically reduces the percentage of your benefits that gets taxed. Most retirees don’t realize that up to 85% of Social Security income can be taxed. But when you delay, that percentage collapses.

The Math:

- Claim at 62 → Up to 85% of benefits taxed

- Claim at Full Retirement Age (66-67) → Up to 50% taxed

- Claim at 70 → Only 15-44% taxed (depending on other income)

Specific Strategy: If you can live on other assets (taxable savings, Roth withdrawals, pension income) between ages 62-70, delaying Social Security can reduce your lifetime tax bill by $50,000 to $200,000+, depending on your total assets.

Real Example: A couple delaying Social Security from age 65 to age 70 reduced their Social Security tax rate from 85% to 44% while keeping the same total annual retirement income of $70,000. Result? They paid 51% less in taxes and withdrew smaller amounts from their IRAs annually.

As a general rule of thumb:

- Don’t take Social Security at 62, unless you have a very short life expectancy due to illness.

- If you think you’ll pass away before 80, start taking it at your Full Retirement Age (FRA), which is between age 66 and 67, depending on when you were born.

- If you think you’ll live beyond 85, wait until age 70.

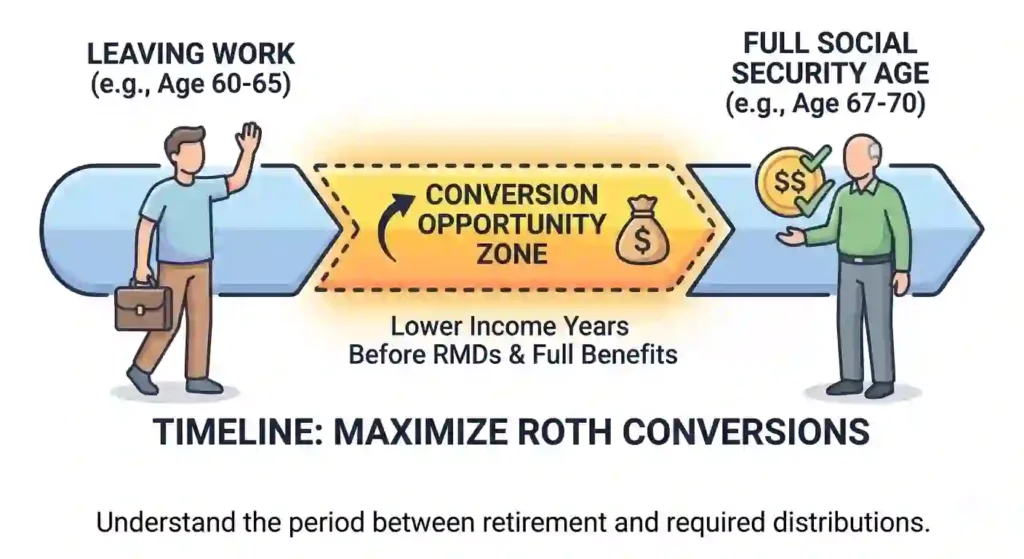

2. Convert Traditional IRA to Roth While in Low-Tax Years

Roth conversions are the most powerful yet underutilized tax strategy in retirement. Here’s why: You’re allowed to convert money from a traditional IRA to a Roth IRA in any year, and you pay income taxes on the converted amount that year only.

The genius of this strategy lies in timing. Convert during years when your income is abnormally low, and you pay tax at a lower rate. After you convert, that money grows tax-free forever.

The Window Opens:

- You leave your job at 62 → Income drops dramatically

- Social Security hasn’t started yet (age 62-70) → No Social Security income

- RMDs haven’t forced you to withdraw → No required income yet

- This creates the perfect “low-income window” for conversions

Conversion Strategy in Action:

If you convert $50,000 in a year when your income is only $40,000 (staying under $97,000 for a single filer in 2026), the entire conversion stays in the 22% tax bracket. You’ll pay roughly $11,000 in taxes—once—and then that $50,000 grows tax-free for the next 30+ years.

Pro-Rata Rule Warning: If you have multiple IRA accounts, the IRS applies the “pro-rata rule.” If 80% of your total IRA money is pre-tax, then 80% of any conversion is taxable. Solution? Roll over your pre-tax IRAs into a 401(k) if your employer’s plan allows it. Then convert only post-tax IRA money to Roth—and pay zero taxes on that conversion.

Key Numbers: Strategic Roth converters can reduce lifetime taxes by $100,000+ while creating a tax-free income stream in their 80s when required minimum distributions would otherwise force them into high tax brackets.

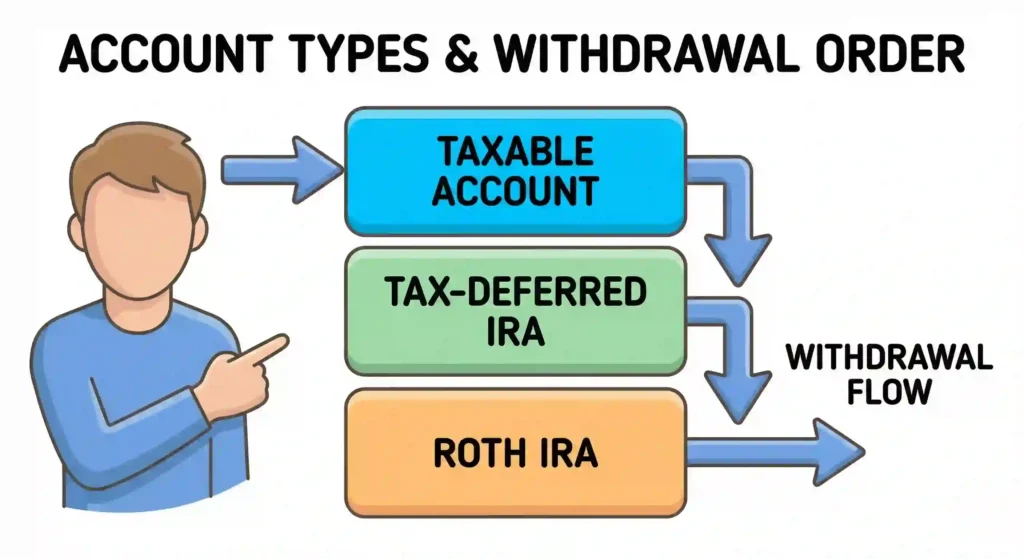

3. Use the “Withdrawal Sequence” Trick to Stay in Lower Tax Brackets

Most retirees withdraw from whatever account is “easiest” to access. The tax professionals withdraw strategically in a specific sequence and the difference can save $20,000-$60,000 per year in taxes.

The order matters because different accounts are taxed differently. If you withdraw $50,000, the source of that $50,000 determines how much you owe in taxes.

The Withdrawal Sequence (In Order):

- Taxable accounts first ($500,000 in regular brokerage account)

- Why? Long-term capital gains taxed at 0%-20% (preferential rates)

- If you have gains that qualify for the 0% capital gains rate (up to $47,025 income for singles in 2026), withdraw aggressively here

- Tax-deferred accounts next ($250,000 in traditional 401(k) and IRAs)

- Why? Every dollar withdrawn is taxed as ordinary income

- Only withdraw here after taxable accounts and your 0% capital gains bracket is “full”

- Tax-free accounts last (Roth IRAs, Roth 401(k)s)

- Why? Withdrawals are completely tax-free and don’t count toward Social Security taxation

- Keep these growing as long as possible

The Tax Impact: Joe is 62 and needs $60,000 per year from his portfolio. With the wrong sequence, he pays $8,000-$10,000 in annual taxes. With the right sequence, he pays $2,000-$3,000 annually same withdrawal amount, $30,000-$40,000 saved over a 10-year retirement window.

Timing Bonus: By managing your withdrawal sequence, you can also reduce Medicare premiums (which are based on income) and minimize the percentage of Social Security that gets taxed.

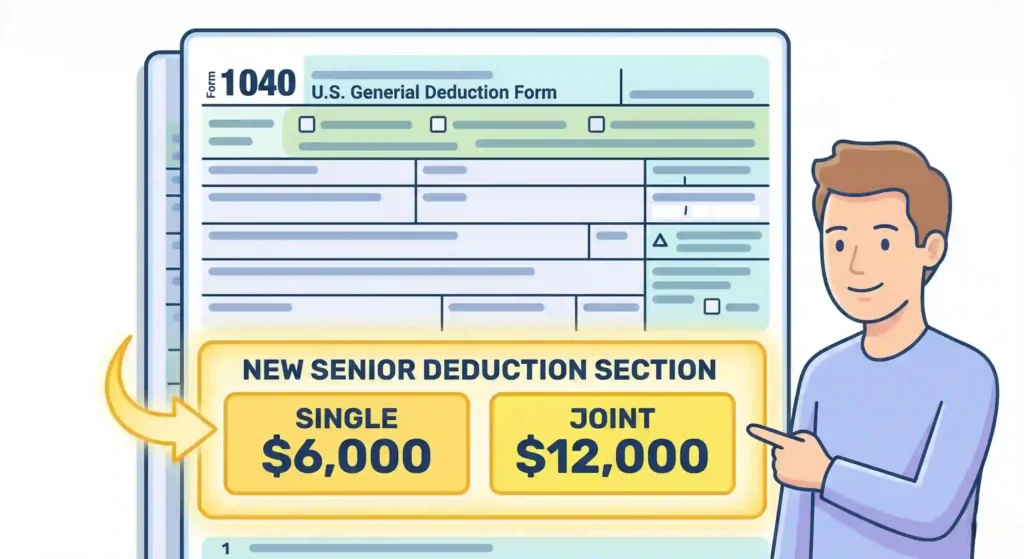

4. Claim the New Senior Deduction (Up to $12,000 in 2026)

Most retirees don’t know this deduction exists. In 2025, Congress created a brand-new “One Big Beautiful Bill” deduction specifically for seniors and it’s worth $6,000 to $12,000 annually, depending on filing status.

This is one of the most straightforward tax cuts available to retirees. You don’t need to “do” anything special you just need to know about it and claim it.

Eligibility & Amounts (2025-2026):

- Age requirement: Must be 65+ at any point during the tax year

- Single filers: $6,000 deduction (phases out above $75,000 income; eliminated above $175,000)

- Married filing jointly: $12,000 deduction (phases out above $150,000 income; eliminated above $250,000)

How It Works: If you’re 66 and single with $80,000 in taxable income, you can deduct $6,000 (assuming it hasn’t phased out at your income level). This lowers your taxable income to $74,000 saving you roughly $1,000-$1,500 in federal taxes immediately.

Phaseout Thresholds (Know Your Number):

- Single filers: Deduction begins to phase out at $75,000 income

- Married filing jointly: Phase out begins at $150,000 income

- Completely eliminated at $175,000 (single) or $250,000 (married)

Claiming It: Online tax software will automatically apply this deduction if you qualify. For paper filers, check the box on Form 1040 indicating you’re 65 or older, and the IRS will apply it automatically.

Tax Savings: This deduction alone can save $1,000-$2,000 per year for the average retired couple a total of $15,000-$30,000 over a 15-year retirement.

5. Maximize Healthcare Deductions ($7,750+ Written Off)

Here’s a tax secret that accountants and financial advisors exploit constantly: Healthcare costs for retirees are deductible often more generously than you’d expect.

While healthcare costs have nearly tripled for retirees since 2010, the IRS allows you to write off significant portions of your medical and insurance expenses. Most retirees leave $5,000-$15,000 on the table annually by not claiming these deductions.

Medical Expense Deduction:

- Deductible threshold: 7.5% of adjusted gross income (AGI)

- Example: If your AGI is $80,000, you can only deduct medical expenses above $6,000

- If you spend $10,000 on medical costs, you can deduct $4,000

Health Insurance Premiums (Even Higher Limits):

- Health insurance premiums paid out-of-pocket: Often fully deductible

- For self-employed retirees or those with business income: 100% deductible

- Long-term care insurance premiums: Partially deductible (age-based limits, e.g., $575/year for ages 61-70)

Deductions You Might Forget:

- Dental work (orthodontics, root canals, crowns, cleanings)

- Prescription medications

- Vision care (eyeglasses, contacts, LASIK)

- Hearing aids and related care

- Medical equipment (blood pressure monitors, glucose monitors, hospital beds)

- Mileage to medical appointments: $0.21 per mile (2025)

- Nursing home care (if needed for medical reasons)

Real Example: Margaret, 72, spent $14,000 on medical expenses last year (health insurance $8,000, dental work $4,000, medications $2,000). Her AGI is $75,000. She can deduct any medical costs above $5,625 (7.5% × $75,000). Total deduction: $8,375 × 24% tax bracket = $2,010 in tax savings.

Strategic Planning: Retirees often “bunch” medical expenses in high-expense years (after surgery, dental work, or hearing aids). Paying bills in December rather than January can push you over the 7.5% threshold and unlock thousands in deductions.

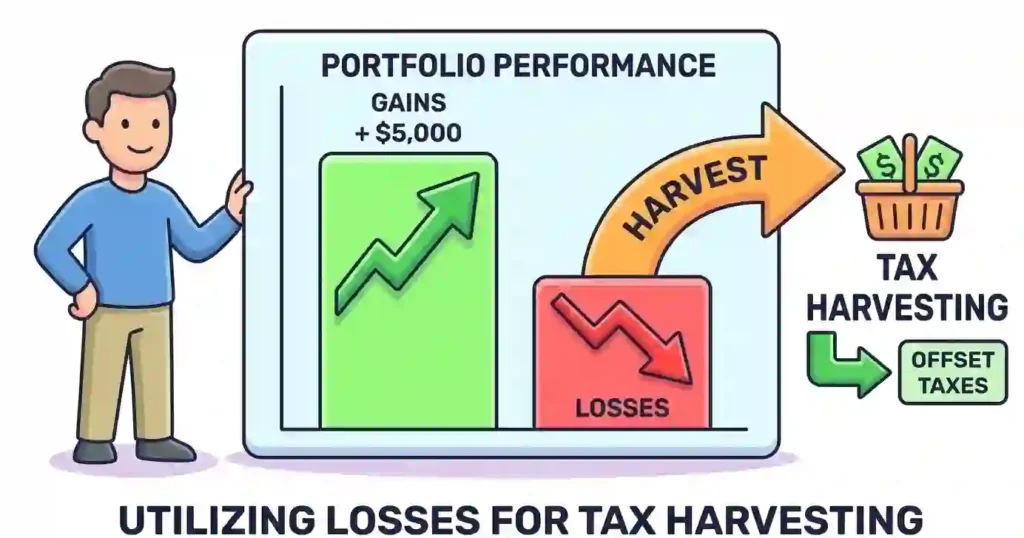

6. Manage Capital Gains With “Tax-Loss Harvesting”

Tax-loss harvesting sounds complex. It’s actually simple: Sell investments that have lost value to offset capital gains from investments that have gained value.

This is the strategy used by sophisticated investors and retirees to reduce taxable income dramatically while maintaining their investment exposure.

How Tax-Loss Harvesting Works:

Example: You own two index funds in your taxable brokerage account:

- Fund A: Worth $60,000 (you paid $50,000) = $10,000 gain

- Fund B: Worth $18,000 (you paid $20,000) = $2,000 loss

Step 1: Sell Fund B and realize the $2,000 loss

Step 2: Immediately buy a similar fund (not the identical same fund) to maintain exposure

Step 3: Use the $2,000 loss to offset the $10,000 gain

Result: You owe tax on only $8,000 gain instead of $10,000 = roughly $1,200-$2,000 in tax savings

The Secret Move: If your losses exceed your gains in a year, you can deduct up to $3,000 of “net losses” against ordinary income. Any excess loss carries forward indefinitely to future years.

Real Strategy for Retirees: Retirees in lower tax brackets can use losses to create a “loss carryforward bank.” Harvest $10,000 in losses this year, even if you don’t have $10,000 in gains. You deduct $3,000 against income, and carry forward $7,000 to use in future years when you might have higher gains.

Wash Sale Rule Warning: Don’t buy the identical same security within 30 days of selling it at a loss. The IRS calls this a “wash sale” and disallows the loss. Solution? Sell VTSAX, immediately buy VTI (similar but different fund).

Annual Impact: Tax-loss harvesting can unlock $1,000-$5,000 in annual tax deductions for retirees with substantial taxable investments, compounding to $50,000-$100,000+ in lifetime tax savings.

7. Time Charitable Giving With “Qualified Charitable Contributions”

The most tax-efficient way to donate to charity in retirement doesn’t involve itemizing deductions at all. In fact, it bypasses your taxable income entirely.

For retirees age 70½ or older, a “qualified charitable contribution” (QCD) lets you donate directly from your IRA to charity and the money never shows up as taxable income on your tax return.

Why This Matters: If you must take a $30,000 required minimum distribution (RMD) from your IRA at age 75, that $30,000 counts as taxable income, potentially pushing you into a higher tax bracket and increasing the percentage of Social Security that gets taxed. But if you do a QCD instead, that $30,000 goes directly to charity and avoids taxable income entirely.

New 2026 Benefit (Non-Itemizers): Starting in 2026, all retirees (not just those doing QCDs) can deduct up to $1,000 (or $2,000 if married filing jointly) in cash charitable contributions without itemizing. This is separate from the QCD and opens a new tax-reduction avenue.

The Mechanics:

- You’re age 70½ or older

- Your IRA custodian (Fidelity, Vanguard, etc.) sends a check directly to the charity

- The donation counts toward your RMD requirement (if you have one)

- The $30,000 never appears on your tax return as income

- You save $6,000-$10,800 in taxes (20%-36% bracket)

Who Benefits Most: Retirees who:

- Have substantial IRAs

- Don’t need all their RMD income to live

- Are charitably inclined

- Are in 24% or higher tax brackets

Lifetime Impact: A retiree doing $20,000/year in QCDs from age 70 to 95 can reduce taxes by $150,000-$240,000 over 25 years while supporting charities they care about.

Pro Tip: Even if you’re not age 70½ yet, you can “cluster” charitable giving into specific years to push past the standard deduction threshold. Donate $10,000 this year and zero next year (instead of $5,000 both years). This unlocks itemized deductions and saves thousands on the donation.

FAQ SECTION

Q1: What’s the biggest mistake retirees make with taxes?

A: Withdrawing from the wrong account in the wrong order. Most retirees default to taking distributions from whatever account is easiest to access often tax-deferred accounts (401k, traditional IRA) first. This creates a “tax bump” where they pay tax on ordinary income rates (22%-37%) instead of capital gains rates (0%-20%). Reversing this sequence and withdrawing from taxable accounts first (using 0% capital gains bracket), then tax-deferred, then Roth, can cut taxes by 30-50%.

Q2: Should I wait until age 70 to take Social Security?

A: Not for everyone, but for most. If you’re healthy and expect to live beyond 85, waiting is beneficial. Each year you delay from 62 to 70 increases your benefit by 8%. But more importantly, delaying reduces the percentage of your benefits that get taxed from 85% down to as low as 15%. If you need income before 70, use other assets (taxable savings, Roth withdrawals). If you’ll die before 80, claim at your Full Retirement Age (66-67) instead of 62 to reduce the tax hit.

Q3: Is a Roth conversion worth it if I have to pay taxes on it now?

A: Almost always yes, if done in the right year. Convert during “low income windows” between leaving work and starting Social Security. If you convert $50,000 in a year when your income is low, you might pay 22% tax ($11,000). That money then grows tax-free for 30+ years. Compare this to traditional IRA money that will eventually be taxed at 24%-37% when withdrawn in your 80s, or when forced RMDs start. The math favors converting early.

Q4: Can I claim medical expenses as a deduction in retirement?

A: Yes, but only if you itemize (and they exceed 7.5% of your AGI). Most retirees with lower incomes don’t itemize anymore due to the high standard deduction ($16,550 single, $33,100 married in 2025). However, health insurance premiums (Medicare supplements, long-term care insurance) are often fully deductible, and healthcare costs in specific situations (self-employed status, high medical years) can unlock deductions worth $2,000-$5,000 annually.

Q5: What’s the smartest tax move I can make in 2026?

A: Claim the new senior deduction ($6,000-$12,000), then do a Roth conversion if you’re in a low-income year, then harvest tax losses in your brokerage account. These three moves total implementation time under 1 hour can save $5,000-$15,000 in a single tax year. Multiply that over a 20-year retirement, and you’re looking at $100,000-$300,000 in lifetime tax savings.