Medicare Supplement Plan G is simple to understand on the surface it covers most of what Medicare doesn’t. But like Social Security optimization, the real strategy lies beneath what the marketing brochures tell you. There are hidden benefits that can save you thousands, protect you in unexpected ways, and give you peace of mind that most people never leverage.

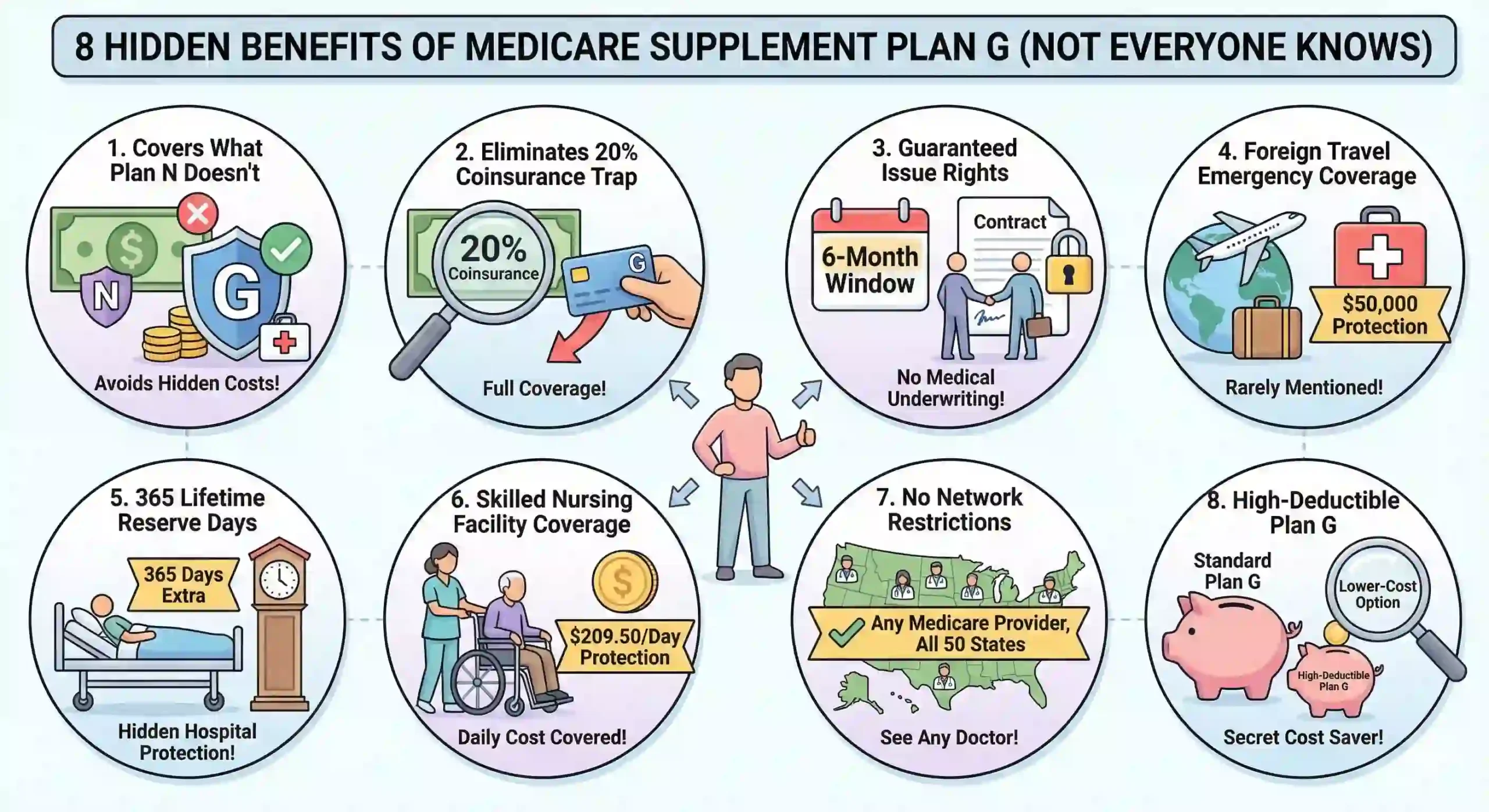

1. It Covers the One Thing Plan N Doesn’t and This Could Cost You Thousands

When a doctor charges more than Medicare allows, you’re on the hook. This is called an “excess charge,” and it’s one of the biggest hidden costs in healthcare. If a non-participating provider charges 15% above the Medicare-approved amount, you pay that difference unless you have Plan G.

Here’s the secret: Only Plan G (among current Medigap plans) covers excess charges. Plan N doesn’t. Plan A, B, D, and others? No coverage. This single benefit can save you hundreds on a single specialist visit.

Why This Matters:

- A dermatologist appointment approved at $200 by Medicare could be billed at $230

- That $30 excess charge? You’d normally pay it all

- With Plan G, the plan pays it

- Multiply this by specialist visits throughout the year

The catch: About 96% of doctors accept Medicare assignment and won’t charge excess fees. But that 4% who do often psychiatrists, some surgeons, and specialty providers can hit you hard. With Plan G, you’re protected regardless.

Real Math: One non-participating cardiologist charges excess fees. One visit at $500 approved amount = potential $75 excess charge you wouldn’t pay with Plan G.

2. The 20% Coinsurance Trap That Plan G Eliminates (Most People Don’t Realize This)

Medicare Part B covers 80% of approved services. That means you cover 20%. Sounds simple, right? The problem: That 20% has no cap. A $10,000 surgery, $20,000 imaging bill, or $50,000 specialty treatment you’re on the hook for 20% of all of it with Original Medicare alone.

Plan N leaves you exposed here. You still pay the full 20% coinsurance on everything after the Part B deductible, except for some office visit copays. Plan G eliminates this entirely.

The Hidden Problem With 20% Coinsurance:

- Average hip replacement cost (Medicare-approved): ~$35,000 → You’d pay $7,000 (20%)

- Average back surgery: ~$40,000 approved → You’d pay $8,000 (20%)

- Multiple imaging tests and specialist consultations add up fast

With Plan G, after you pay the $283 Part B deductible for 2026, everything else is covered at 100%. No matter how expensive the treatment gets.

Why This Is a Hidden Benefit: Insurance companies don’t advertise “unlimited coinsurance” because it sounds scary. Most people see “80% covered” and think they’re fine. They’re not.

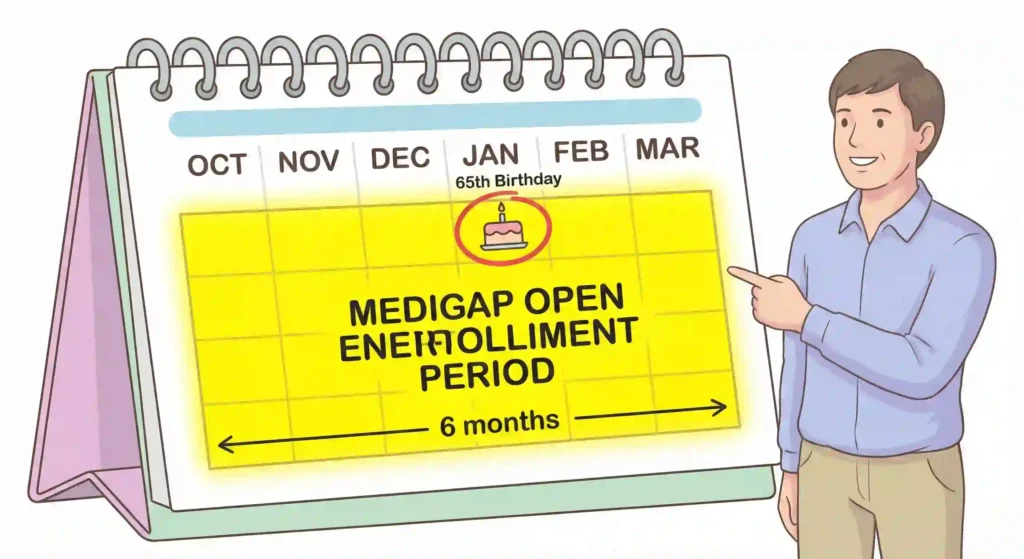

3. Guaranteed Issue Rights Your 6-Month Window to Buy Without Medical Underwriting

Here’s a benefit most people don’t think about until it’s too late: Guaranteed issue rights. When you turn 65 and enroll in Medicare Part B, you enter a six-month window where insurance companies must sell you Plan G no questions asked, no health screening, no denial based on pre-existing conditions.

This is massive. It means:

Guaranteed Issue Protects You:

- Diagnosed with diabetes last month? Doesn’t matter they still have to sell you Plan G

- Heart condition? Recent cancer diagnosis? Still guaranteed coverage

- No waiting periods. Coverage begins the first of the month

- You get the best rate for your age at that time

Miss This Window? After those six months, you’re subject to medical underwriting. Insurance companies can deny you. They can charge you higher premiums. A health event between month 6 and when you apply for Plan G could mean you can’t get the coverage you want.

Real Scenario: A 66-year-old applicant had a stroke at month 7. When they tried to enroll in Plan G, the insurance company required additional health screening and quoted a premium 40% higher than standard rates. If they’d enrolled during their guaranteed-issue window, it would have cost $150/month. Now: $210/month.

This benefit alone can save you tens of thousands in lifetime premiums if you have a health event after your window closes.

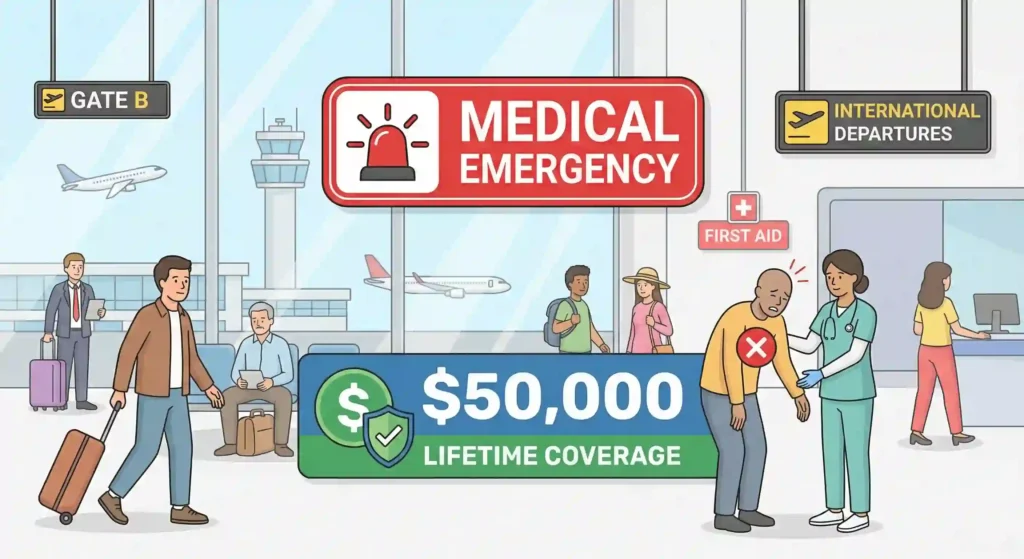

4. Foreign Travel Emergency Coverage $50,000 Protection That Rarely Gets Mentioned

Most retirees don’t think about this until they’re on a plane to Europe: What if you have a medical emergency abroad? Medicare doesn’t cover you outside the US. But Plan G does up to a point.

Plan G covers 80% of emergency medical care outside the US, up to a $50,000 lifetime maximum, after you pay a $250 deductible. This applies to the first 60 days of any trip.

The Hidden Value:

- Emergency hospitalization in Mexico: Could cost $15,000-$30,000 out-of-pocket

- Sudden cardiac event in Canada: Emergency room + diagnosis could run $5,000+

- Appendix surgery while in Europe: $20,000+ not unusual

Plan G’s foreign travel benefit would cover 80% of these after your $250 deductible.

Math Example: $10,000 emergency while traveling in Costa Rica.

- You pay the $250 deductible

- Remaining: $9,750

- Plan G covers 80%: $7,800

- You pay 20%: $1,950

- Total out-of-pocket: $2,200 (instead of $10,000)

Limitation to Know: Coverage only applies during the first 60 days of any trip. If you’re traveling for 90 days, anything after day 60 isn’t covered. Extended travelers need additional travel insurance.

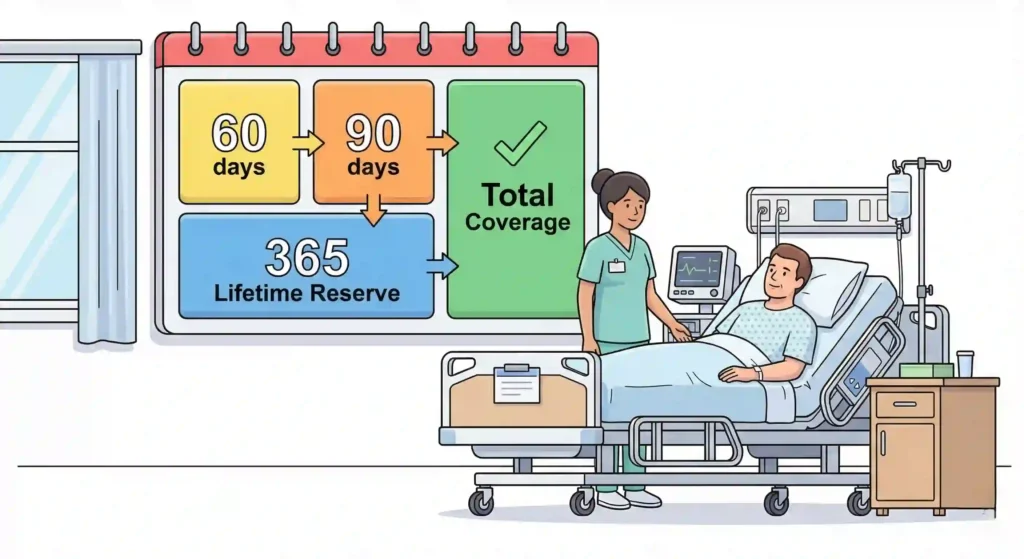

5. The 365 Lifetime Reserve Days Benefit (Hidden Hospital Cost Protection)

Medicare Part A covers 60 days of hospital care per benefit period, then 90 more days. After that, you’re done for that benefit period. But Plan G gives you something Original Medicare doesn’t: 365 additional lifetime reserve days.

Here’s how it works:

- Days 1-60 in hospital: Medicare pays (you pay the Part A deductible)

- Days 61-90: Medicare covers but with daily coinsurance ($419/day in 2025)

- Days 91-150: Your lifetime reserve days kick in, covered at 100%

- Days 151+: No coverage from Medicare or your plan

The Hidden Advantage: Most people never need these days. But if you do a long recovery, extended rehabilitation, complications that keep you hospitalized Plan G doesn’t just cover the days; it covers 100% of the costs on those days (including the coinsurance amounts Medicare would normally bill you).

Real-World Scenario: A 72-year-old with complications after hip replacement surgery spent 85 days in the hospital. After using his 60 + 90 Medicare days, he had 10 more days he couldn’t afford. With Plan G, those 10 additional days (at roughly $400/day in hospital costs) were covered at 100%. Value: $4,000 in protected costs.

Why It’s Hidden: People rarely talk about this benefit because people don’t often need extended hospital stays. But for those who do, it’s a lifesaver.

6. Skilled Nursing Facility Coinsurance Coverage (The $209.50/Day Protection)

After a hospital stay, many seniors need skilled nursing facility (SNF) care physical therapy, occupational therapy, skilled wound care. Medicare Part A covers this, but with coinsurance. Days 21-100 of SNF care? You pay $209.50 per day (2025 rates). Multiply that by 30 days, and you’re looking at $6,285 out-of-pocket.

Plan G covers 100% of this SNF coinsurance. Every dollar of that $209.50/day coinsurance is paid by your plan.

The Numbers:

- 30-day SNF stay: You’d pay $6,285 without Plan G

- 50-day SNF stay: You’d pay $10,475 without Plan G

- With Plan G: $0 coinsurance

Common SNF Scenarios:

- Hip replacement → 3-4 week recovery in SNF → $6,000-$8,000 saved

- Stroke recovery → Extended therapy → $8,000-$12,000 saved

- Major surgery complications → Additional SNF days → Coverage adds up quickly

Hidden Value: Most people don’t understand SNF costs until they need it. By then, they’ve already committed to a plan. With Plan G, you’re protected from the start.

This single benefit often justifies the higher Plan G premium in the first major hospitalization requiring SNF care.

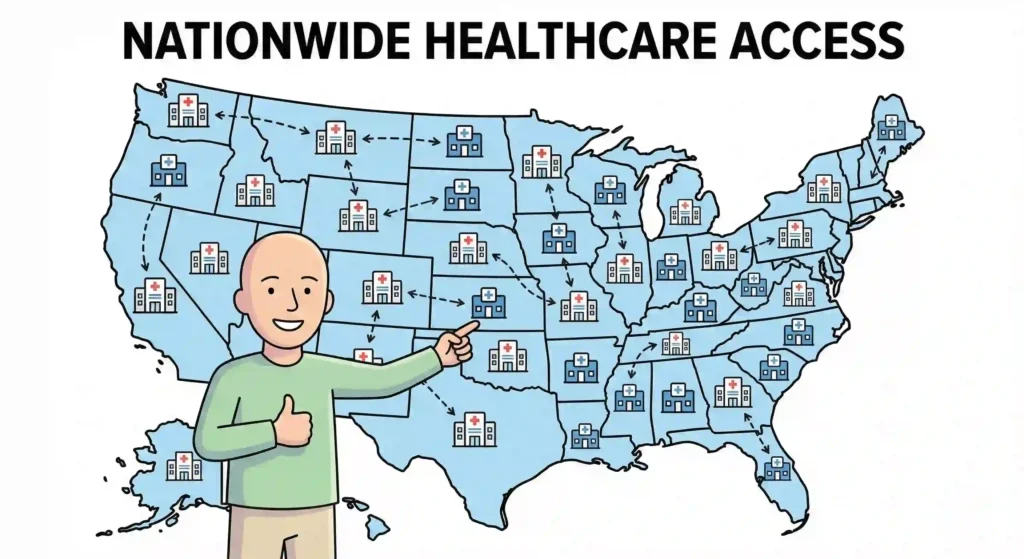

7. No Network Restrictions See Any Medicare-Accepting Provider in All 50 States

This one sounds obvious, but it’s a hidden benefit when you compare it to Medicare Advantage. With Plan G, you have true freedom: You can see any doctor, any specialist, any hospital that accepts Medicare. No networks. No “in-network” vs “out-of-network.” No restrictions on where you live or travel.

What This Actually Means:

- Moving to a different state? Your Plan G goes with you at no cost

- Want to see that top cardiologist two states away? Go ahead

- Snowbirding between states? You’re covered everywhere

- Want a second opinion from a prestigious medical center? No pre-approval needed

With Medicare Advantage, your coverage is tied to a specific region. Move out of your plan’s service area, and you lose coverage. Go out-of-network, and you pay much more.

Hidden Financial Protection: This freedom prevents you from being forced into inferior care due to geography. A senior with Plan G diagnosed with a rare condition can fly across the country to see a specialist. With Advantage, you’re limited to in-network providers, and rural areas have very few options.

Real Value: One retiree was offered a 6-month volunteering position in Colorado. With Medicare Advantage, she’d have had to decline or lose coverage. With Plan G, she kept her same coverage across all Medicare-accepting providers. Value: The ability to maintain lifestyle without healthcare penalties.

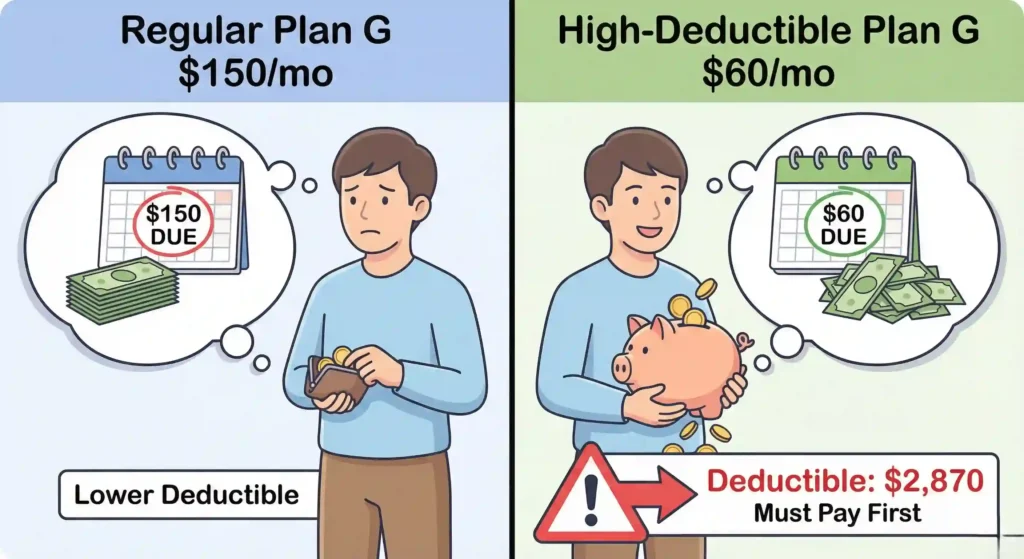

8. High-Deductible Plan G The Secret Lower-Cost Version Most People Miss

Here’s a benefit that exists but is almost never discussed: High-Deductible Plan G (HD-G). It’s available in most states and works like a high-deductible health plan but for Medicare.

How It Works:

- You pay a much lower monthly premium (~$60-$80/month vs $140-$236/month for regular Plan G)

- BUT you pay the first $2,870 of Medicare-approved expenses each year

- Once you hit $2,870, Plan G covers 100% of everything else

The Math That Works:

- Regular Plan G: $150/month × 12 = $1,800/year in premiums alone

- HD-G: $70/month × 12 = $840/year in premiums

- Premium savings: $960/year

- If you need $5,000 in care:

- HD-G: Pay $2,870 deductible + $840 premiums = $3,710 total

- Regular Plan G: Pay $0 care costs + $1,800 premiums = $1,800 total

Where HD-G Wins: Healthy seniors with minimal medical expenses. If you go a whole year with minimal care (under $2,870 in expenses), you save over $1,000 annually.

Why It’s Hidden: Insurance agents often push regular Plan G because the commissions are higher and the plan is “easier to sell.” HD-G requires more education. Healthier seniors who research their options often find this gem.

Important Note: HD-G is NOT available in all states. Check with your insurance broker to see if it’s available in your area. Also note: Some see this as risky because the $2,870 deductible does include the Part B deductible, meaning you could face unexpected costs if you have extensive medical care early in the year.

FREQUENTLY ASKED QUESTIONS

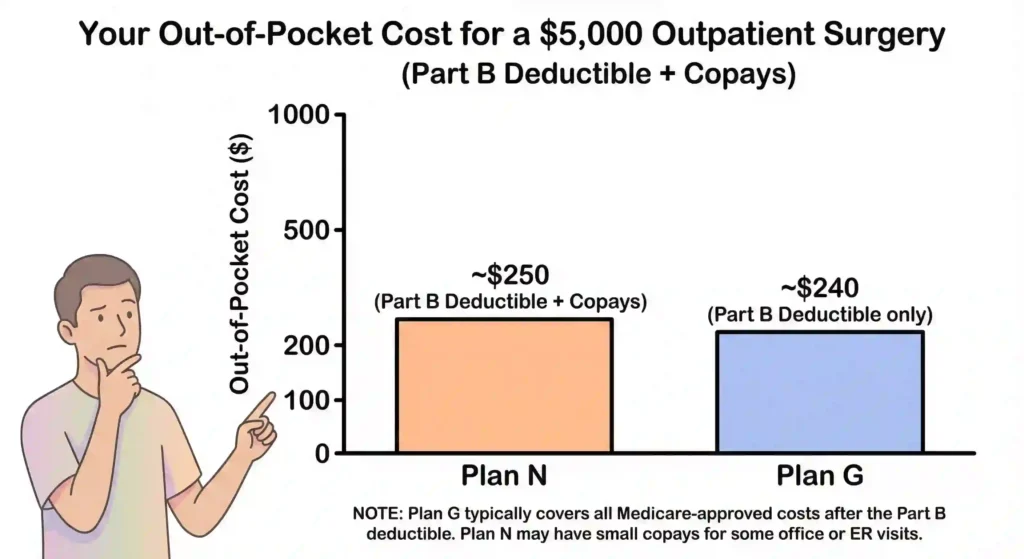

Q: Is Plan G really worth the higher premium compared to Plan N?

A: It depends on your healthcare usage. If you see doctors regularly or have multiple specialists, Plan G typically pays for itself within the first year when you factor in the cost of Plan N’s copays ($20 for office visits, $50 for ER) plus Plan N’s lack of excess charge coverage. However, if you’re very healthy and rarely visit doctors, Plan N’s lower premiums (~$20-$50 less per month) could save you money if you avoid costs. Use a calculator specific to your state and expected healthcare needs.

Q: When can I enroll in Plan G without medical underwriting?

A: You have a 6-month guaranteed issue period starting the first day of the month you turn 65 and enroll in Part B. During this window, insurance companies must sell you Plan G regardless of health history. After 6 months, you may need medical underwriting. You also get guaranteed issue rights in specific situations: when a Medicare Advantage plan leaves your area, when your employer coverage ends, or if you were in employer group health coverage and it terminates. Always act within the 63-day window after these events.

Q: What’s not covered by Plan G that I should know about?

A: Plan G does NOT cover: (1) The Medicare Part B annual deductible ($283 in 2026) you pay this yourself; (2) Prescription drugs you need a separate Part D plan; (3) Dental, vision, or hearing coverage; (4) Long-term care or custodial care; (5) Routine foot care or acupuncture; (6) Dentures or cosmetic surgery. Plan G supplements Original Medicare; it’s not a replacement plan.

Q: If 96% of doctors accept Medicare assignment, how often do excess charges really happen?

A: It’s rare but impactful when it does. Excess charges most commonly appear with psychiatrists, some orthopedic surgeons, and certain specialists. One study from KFF (Kaiser Family Foundation) found that while rare, excess charges on a single service can range from $10-$100+, and for complex procedures or multiple visits, they can accumulate. The value of Plan G’s excess charge coverage isn’t that you’ll use it constantly it’s that when you do encounter a non-participating provider, you’re fully protected instead of facing surprise bills.

Q: Can my Plan G premiums increase, and if so, how much?

A: Yes, premiums increase yearly based on the insurance company’s pricing model (age-based, issue-age, or community-rated depending on your state). While the federal government standardizes Plan G benefits, insurance companies set their own premiums. On average, Plan G premiums increase 3-5% annually, though this varies by state and company. Some states have stronger rate regulations than others. Always review your renewal notice and compare rates annually you may find better pricing from a different insurer.