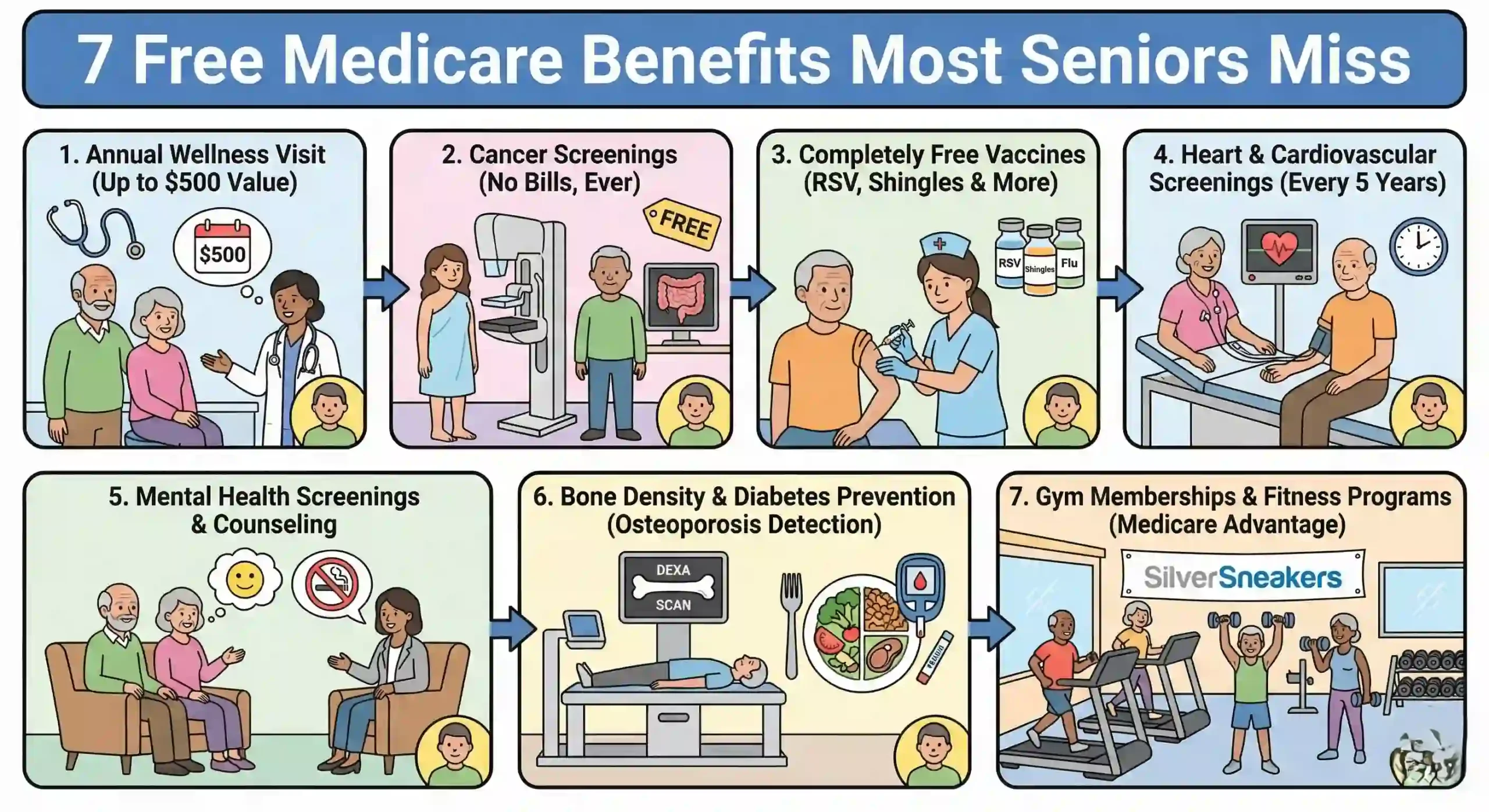

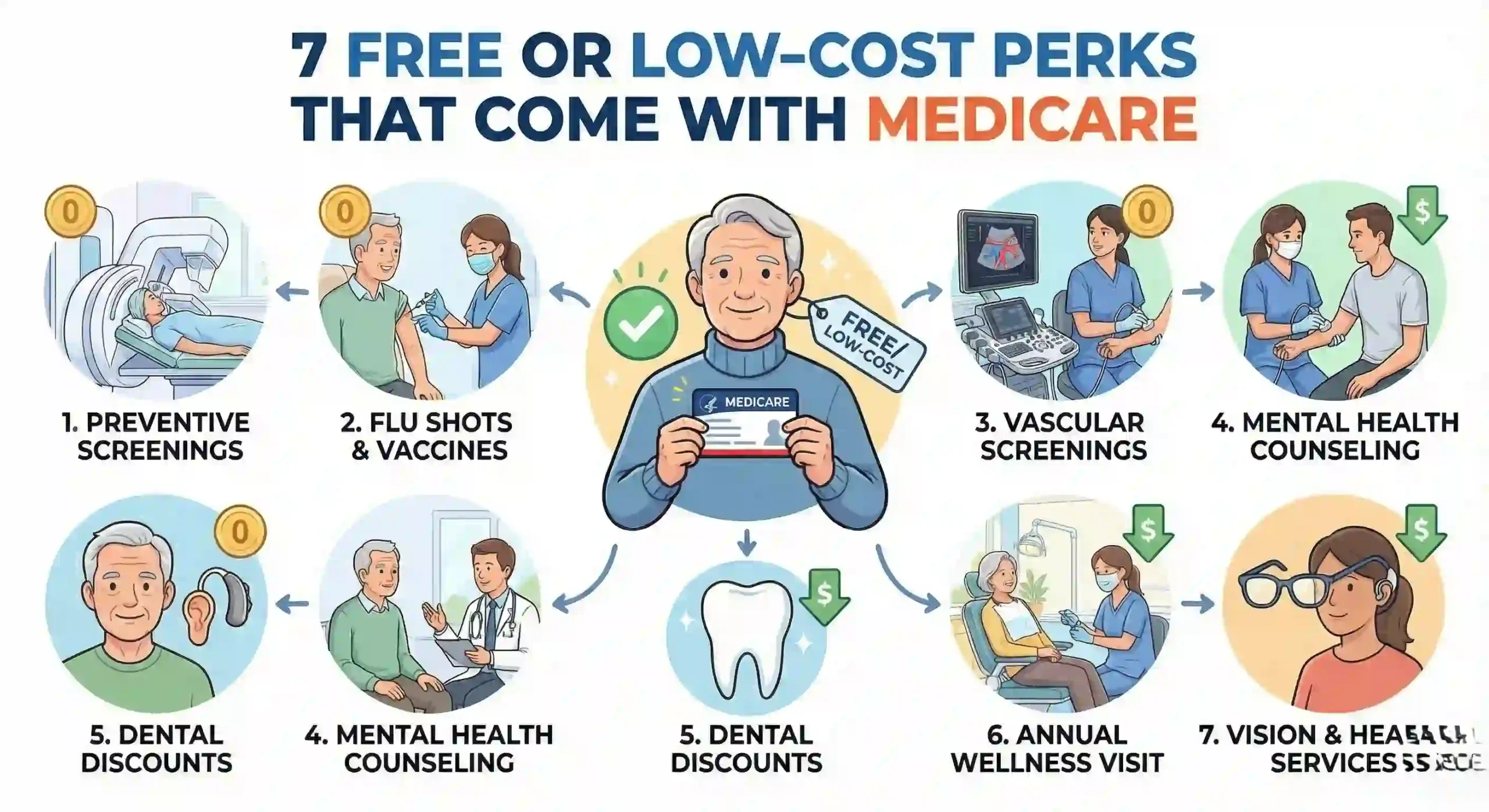

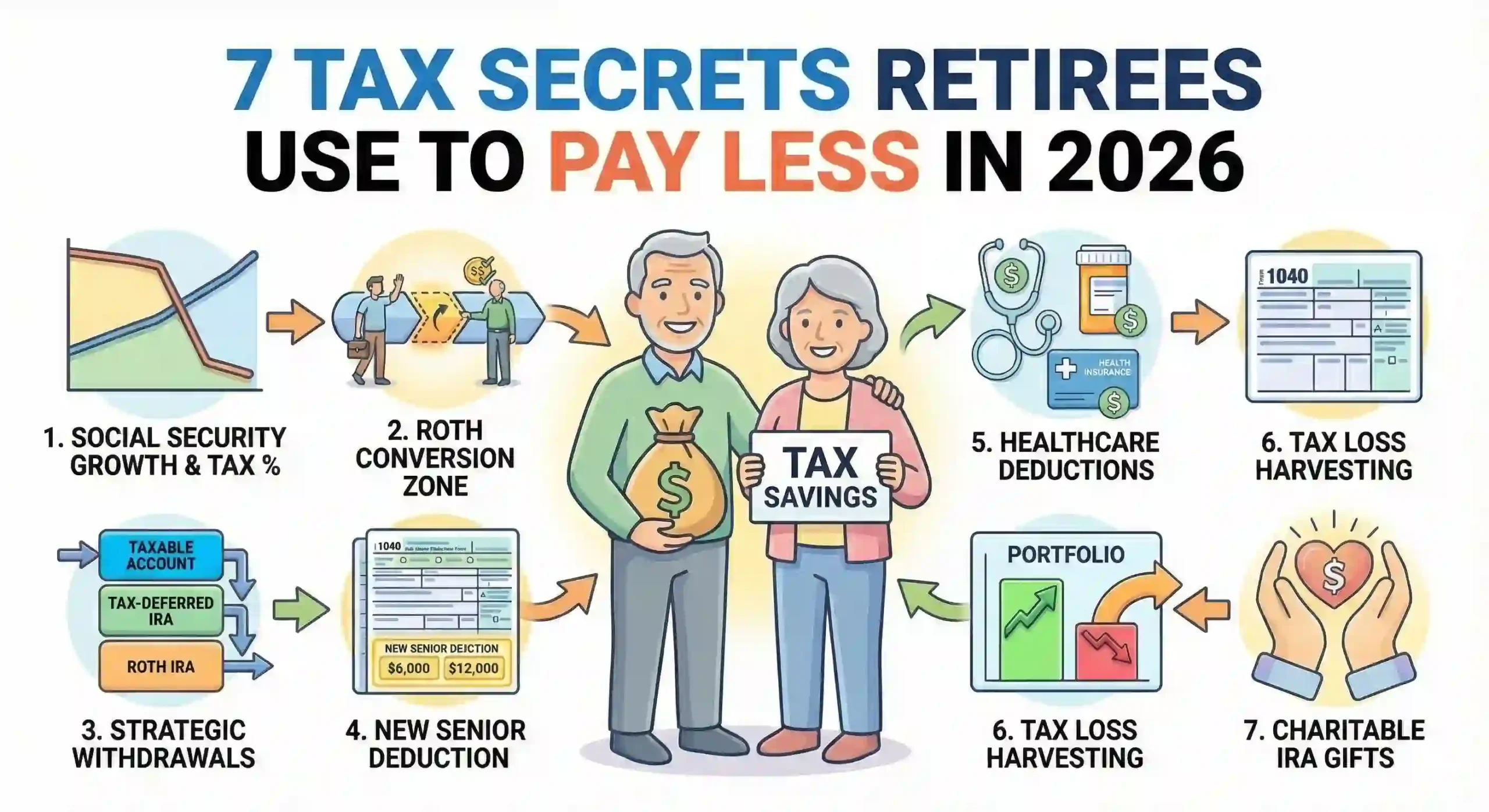

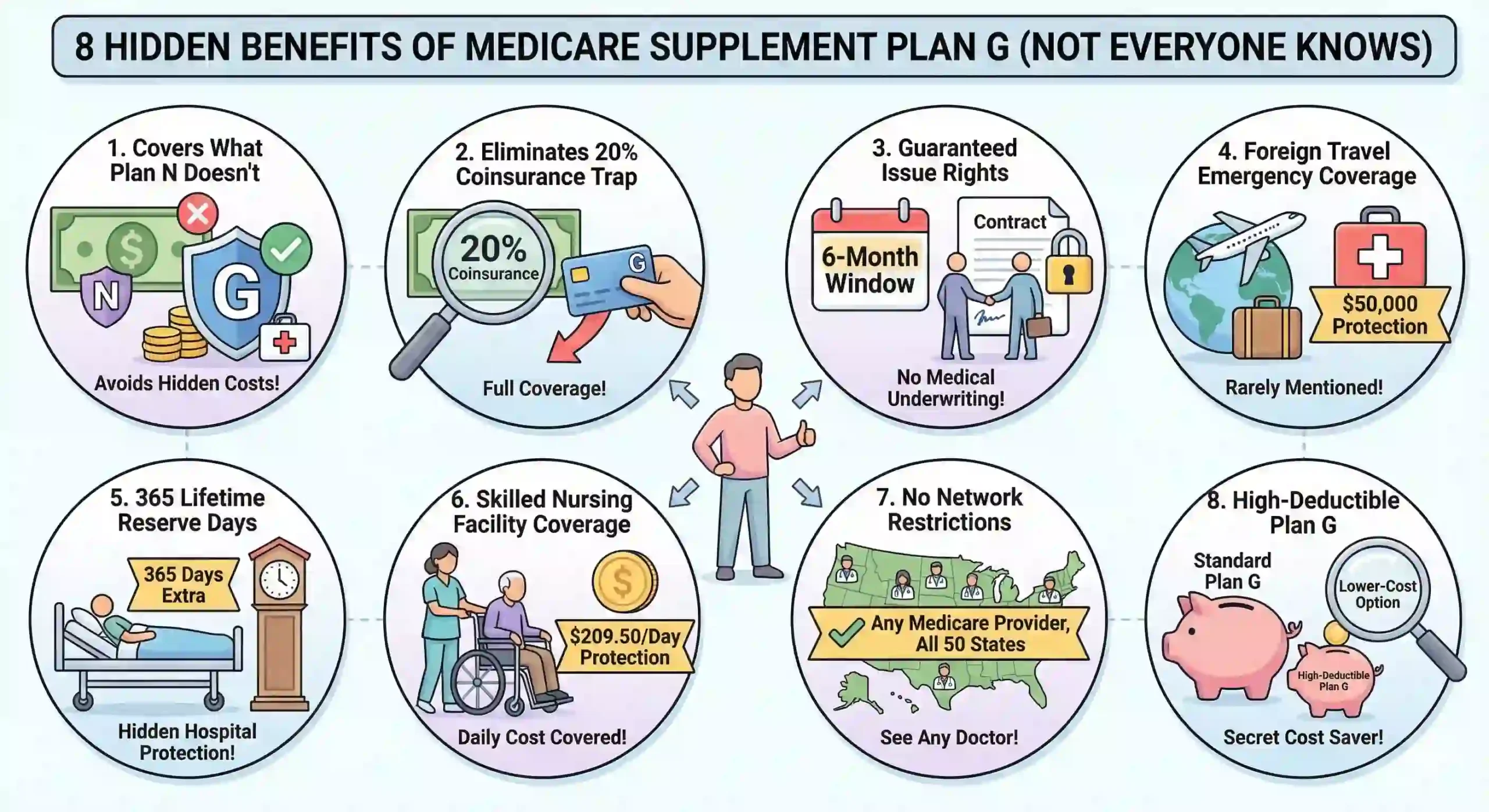

Medicare is deceptively simple on the surface you pay a premium, hit your deductible, then split costs with the government. But the real genius of Medicare lies in what’s hidden in the fine print: dozens of completely free benefits that could save you thousands annually if you know where to look. Most people leave money on the table every single year.

1. Your Free Annual Wellness Visit (Worth Up to $500)

The Problem: You’re paying monthly premiums, yet you still dread the $150–$300 bill that pops up after a routine checkup. Most seniors skip preventive visits because they assume everything costs money. In reality, Medicare will pay for a comprehensive wellness visit completely free every single year.

Here’s the exact breakdown:

Welcome to Medicare Visit (First Year Only)

- Must happen within your first 12 months on Part B

- Covers medical and family history review

- Blood pressure, height, weight measurements

- Cognitive impairment screening (catches early dementia signs)

- Vision screening

- Medication review (critical for drug interactions)

- Free advance directive counseling

- Zero copay, zero deductible

Annual Wellness Visit (Year 2 Onward)

- Happens once every 12 months, on your schedule

- Personalized preventive care plan based on your health risks

- Same benefits as the initial visit

- Completely free if your doctor accepts Medicare assignment

Why This Matters: A private wellness physical costs $200–$500 out of pocket. Medicare covers this annually at no charge. Over a 20-year retirement, that’s $4,000–$10,000 in free healthcare.

The Catch: Must use in-network providers. If you see someone who doesn’t accept Medicare assignment, you may be charged.