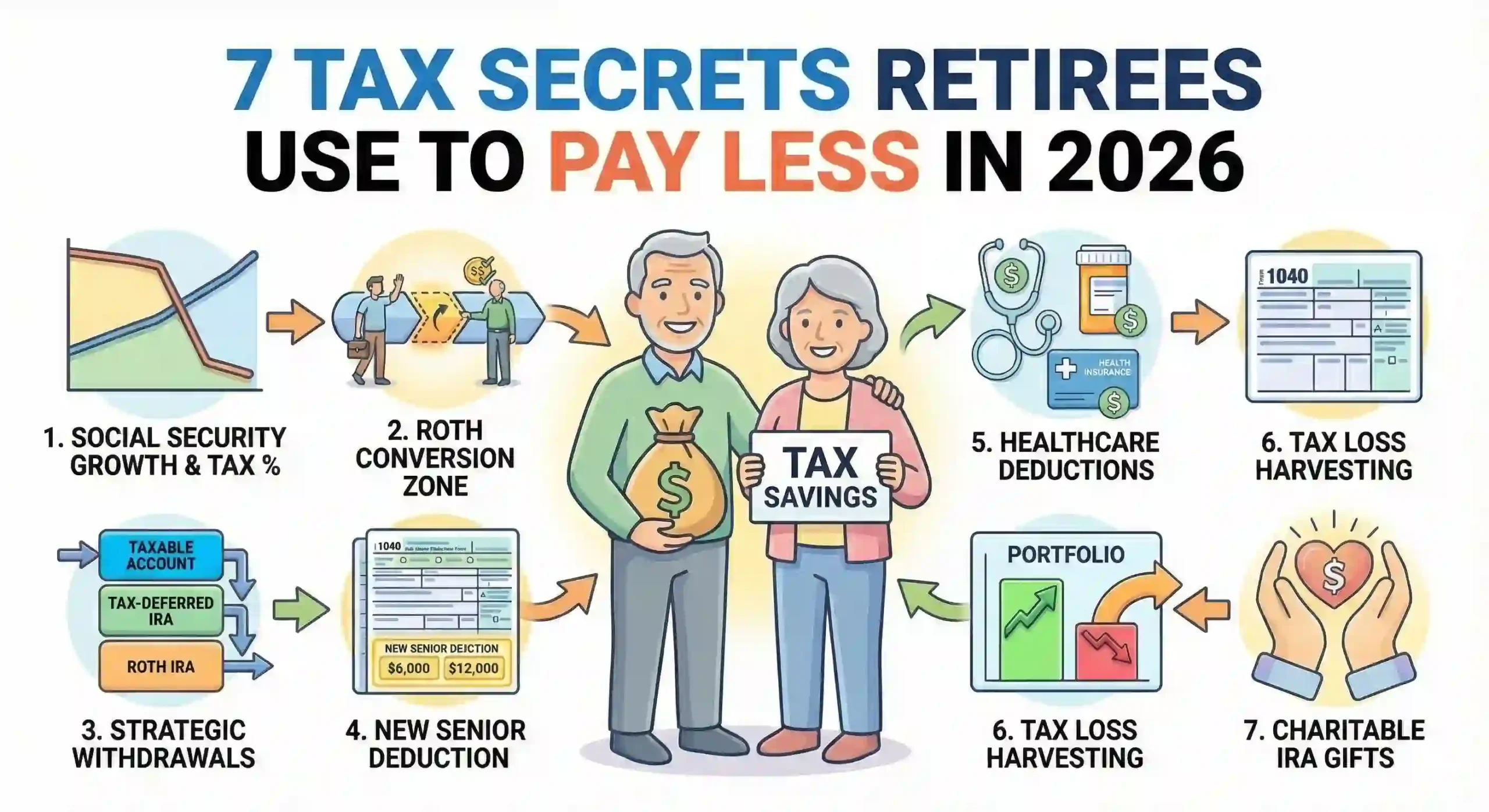

Maximizing retirement income isn’t just about saving it’s about knowing which tax breaks actually apply to your situation. The good news? The IRS offers nine distinct tax credits designed specifically for retirees that can collectively save you thousands per year, but the strategy behind claiming them separates smart savers from those who leave money on the table.

1. The Credit for the Elderly or Disabled (Up to $7,500)

Most retirees have heard of this credit but have no idea they qualify. If you’re age 65 or older (or retired on permanent and total disability), the IRS allows a tax credit that ranges from $3,750 to $7,500 depending on your filing status. This isn’t a deduction it’s a dollar-for-dollar credit that directly reduces your tax bill.

Who Qualifies:

- Age requirement: 65 or older by December 31 of the tax year

- Disability clause: Retired on permanent disability before age 65 (any age qualifies)

- Income limits: Adjusted gross income cannot exceed $25,000 (married filing jointly), $17,500 (single)

- Combined nontaxable pension, annuity, and disability income limits must also fall below thresholds

The Strategy: File Schedule R (Form 1040) to claim this credit. Many retirees skip this because they think their income is too high, but the calculation is complex combining both your AGI and nontaxable retirement income sources. If either threshold is exceeded, you’re phased out, so review carefully.

Key Data: The credit provides between $3,750 and $7,500 depending on your exact filing status and whether your spouse also qualifies, making this one of the most generous credits available to seniors.

2. The Saver’s Credit: $1,000–$2,000 Cash Back on Retirement Savings

If you’re in your early retirement years or have moderate income, the Saver’s Credit is a hidden goldmine. You can claim up to $2,000 (or $1,000 for single filers) as a tax credit simply for contributing to an IRA, 401(k), or similar retirement account even small contributions count. Many retirees miss this entirely because they don’t realize the credit still applies after retirement.

Income Limits for 2026:

- 50% credit: Married filing jointly ($48,500 AGI), head of household ($36,375), single ($24,250)

- 20% credit: MFJ up to $52,500, head of household up to $39,375, single up to $26,250

- 10% credit: MFJ up to $80,500, head of household up to $60,375, single up to $40,250

Maximum Eligible Contributions: $4,000 (joint filers) or $2,000 (all other filers)

The Strategy: If you’re doing a backdoor Roth conversion or making catch-up contributions to an IRA after age 50, this credit can offset a significant portion of those contributions. You’ll claim it on Form 8880 but the credit disappears for taxpayers above the AGI thresholds, so timing your income matters.

Key Data: The average Saver’s Credit claimed in 2022 was $194, but some retirees qualify for the full $1,000–$2,000. The credit is available through tax year 2026, after which it’ll be replaced by a new Saver’s Match program.

3. The New $6,000 Bonus Senior Deduction (Available Through 2028)

Starting in 2025, the One Big Beautiful Bill Act created a brand-new $6,000 deduction exclusively for seniors age 65 and older and this stacks on top of your regular standard deduction. For married couples where both spouses qualify, that’s a combined $12,000 extra deduction. This is separate from the existing higher standard deduction you already get for being over 65.

Key Eligibility:

- Age: 65 or older by December 31 of the tax year

- Income phase-out: Begins at $75,000 (single) or $150,000 (MFJ); completely phases out at $175,000 (single) or $250,000 (MFJ)

- Requirement: Must have a valid Social Security number

- Availability: Tax years 2025–2028 (temporary provision)

- Itemize or standard? This deduction works whether you itemize or take the standard deduction a rare flexibility

The Strategy: Even if you have significant medical expenses or other deductions, you can still claim this $6,000 bonus. This effectively raises your tax-free income threshold by $6,000 per person, reducing your taxable income and your overall tax liability.

Key Data: A single senior filing in 2026 gets: $16,100 (standard deduction) + $2,050 (65+ boost) + $6,000 (new bonus) = $24,150 in total deductions before itemization. For married couples, the math is even more powerful.

4. The Earned Income Tax Credit (EITC): Up to $8,231 for Working Retirees

If you’re still earning W-2 wages or self-employment income in early retirement, the Earned Income Tax Credit can be a massive win especially if you have grandchildren you help support. Single retirees with no dependents can claim up to $664, but add three or more qualifying dependents and that jumps to $8,231 for 2026.

2026 EITC Maximums by Dependent Count:

- No children: $664

- One child: $4,427

- Two children: $7,316

- Three or more children: $8,231

Income Caps (2026):

- Single filer: $62,974 or less

- Married filing jointly: $70,224 or less (with three or more children)

The Critical Rule: Only earned income counts Social Security, pensions, and investment income disqualify you if investment income exceeds $11,950. Disability retirement payments from an employer plan count as earned income until you reach your plan’s minimum retirement age.

The Strategy: If you take a part-time consulting gig, freelance work, or seasonal employment, file Schedule EIC with Form 1040-SR to capture this credit. The EITC is refundable, meaning even if you owe zero tax, you get the credit as a refund.

Key Data: A retiree with three grandchildren they claim as dependents and $50,000 in earned income could receive the full $8,231 EITC often returning thousands in refunds annually.

5. Premium Tax Credit for Health Insurance: Hundreds to Thousands Annually

Early retirees (ages 55–64) who don’t yet qualify for Medicare often face brutal health insurance premiums. The Premium Tax Credit (PTC) reduces those premiums directly, and for many early retirees, the savings run $300–$800+ per month. The credit is refundable, and you can claim it monthly or reconcile it when filing taxes.

Eligibility for 2026:

- Income range: 100%–400% of federal poverty line (approximately $15,060–$60,240 for individuals, 2024 baseline)

- Coverage source: Health insurance purchased through the Health Insurance Marketplace (HealthCare.gov or state exchanges)

- Employer coverage: Cannot have access to affordable employer coverage

- Refundability: Fully refundable even if you have zero tax liability, you receive the credit

The Strategic Play: If you’re considering early retirement and claiming Social Security at 62, be cautious the full amount (including nontaxable portions) counts toward PTC income. Waiting until age 65+ to claim could preserve your premium subsidy. Use the Marketplace estimator to model different income scenarios before filing.

Key Data: An early retiree earning $35,000 annually purchasing a silver plan on the Marketplace could receive a PTC of $400–$600/month depending on their age and location totaling $4,800–$7,200 annually.

6. Energy Efficient Home Improvement Credit: Up to $3,200 Tax Savings

If you’ve been thinking about upgrading your heating system, installing solar, or replacing windows before you retire, the Energy Efficient Home Improvement Credit offers up to $3,200 in tax savings per year. This credit covers 30% of qualifying home improvement costs and is available through December 31, 2025 but retirees often overlook it entirely.

Qualifying Equipment (30% credit):

- Heat pumps (air-source or ground-source): up to $2,000/year

- Heat pump water heaters: up to $2,000/year

- Windows and skylights: up to $600/year

- Exterior doors: up to $500/year total ($250 per door)

- Home energy audits: up to $150

- Insulation, air sealing, biomass stoves

Annual Cap: $1,200 for general energy improvements + $2,000 for qualifying heat pumps/water heaters = $3,200 maximum per year

The Strategy: You must own your home and use it as your principal residence. If you’re renovating in your pre-retirement years, claim the credit on the year installation is completed. Combine with state or local utility rebates to maximize savings.

Key Data: Installing a qualified air-source heat pump (SEER2 13+) could cost $6,000–$8,000, but with the 30% credit ($2,000 max), your net cost drops to $4,000–$6,000. Over time, energy savings recover the investment.

7. Child and Dependent Care Credit: Up to 50% of Care Expenses (New for 2026)

Retirees often become primary caregivers for grandchildren or aging parents. If you pay for childcare or dependent care expenses so you can work or look for work, the Child and Dependent Care Credit is newly enhanced. Starting in 2026, you can claim up to 50% of qualifying expenses not just 35% like previous years putting real dollars back in your pocket.

2026 Credit Structure:

- 50% credit: AGI up to $15,000 (maximum $1,500–$3,000 credit depending on dependents)

- Phase-down: Reduces 1% for each $2,000 AGI over $15,000

- 20% minimum: AGI exceeding $103,000 (single) or $206,000 (MFJ)

- Qualifying expenses cap: $3,000 (one dependent) or $6,000 (two or more)

What Qualifies:

- Daycare center fees

- Summer camps or after-school programs

- Nanny or family daycare payments

- Dependent adult care (qualifying elderly parents or disabled family members)

The Strategy: You must have earned income to claim this credit, and the qualifying person must live with you for more than half the year. Grandparents who take in grandchildren or pay for their care can claim this. Fill out Form 2441 and attach it to your 1040.

Key Data: A retiree with AGI of $30,000 paying $5,000 in annual childcare for a grandchild qualifies for a 40% credit (phased down from 50%) = $1,800–$2,000 tax credit.

8. Adoption Tax Credit: Up to $16,810 Per Child (Now Refundable)

If you or adult children in your household recently finalized an adoption, the Adoption Tax Credit is now fully refundable meaning you can get money back even if you don’t owe taxes. For 2026, qualifying families can claim up to $17,280 per child in qualified adoption expenses. This is one of the most generous credits available, and many retirees don’t realize it applies to grandchildren or adult children’s adoptions.

Credit Amount & Phases:

- 2026 Amount: $17,280 per eligible child (indexed annually)

- Phase-out start: MAGI over $259,190

- Complete phase-out: MAGI over $299,190

- Refundable portion: Up to $5,000 refundable per child

- Carryforward: Unused credits can be carried forward up to five years

Qualifying Expenses:

- Agency fees

- Attorney and court costs

- Travel and meals related to adoption

- Temporary foster care

- Home studies and counseling

The Strategy: You claim the credit on Form 8839 in the year the adoption is finalized. For children adopted in prior years with expenses paid in those years, you can claim them on subsequent returns. If you don’t have enough tax liability, the refundable portion ($5,000) comes back as a check.

Key Data: A couple with $40,000 in adoption expenses finalizing an adoption in 2026 can claim $17,280 immediately. If they owe $12,000 in taxes, their bill is eliminated and they receive a $5,280 refund, with carryforward options for the remainder.

9. American Opportunity Tax Credit: Up to $2,500 for Grandparents Supporting Education

If you’re paying for a grandchild’s college education or your own continuing education in retirement, the American Opportunity Tax Credit (AOTC) offers up to $2,500 per student per year. The credit covers 100% of the first $2,000 in qualified education expenses plus 25% of the next $2,000, and crucially, up to $1,000 of it is refundable you can get money back even with no tax liability.

Credit Amount & Income Limits (2026):

- Up to $2,500 per eligible student per year

- Refundable portion: Up to $1,000 per student

- Income phase-out: $80,000–$90,000 (single), $160,000–$180,000 (MFJ)

- Complete phase-out: Above $90,000 (single) or $180,000 (MFJ)

Qualifying Expenses:

- Tuition and required fees

- Course materials (books, supplies, equipment)

- Room and board (if student is at least half-time)

The Key Restriction: Student must be pursuing a degree or recognized educational credential, attending at least half-time, and you must receive Form 1098-T from the educational institution.

The Strategy: If you’re divorced and your ex-spouse’s income exceeds the threshold, the student might not qualify under their return but if you claim the student as a dependent, you may still qualify. Coordinate with your tax preparer to optimize this.

Key Data: Grandparents with AGI under $80,000 (single) can claim $2,500 per year per grandchild attending college, with $1,000 potentially refunded annually.

FREQUENTLY ASKED QUESTIONS

Q: How much can retirees save using tax credits?

A: Collectively, retirees can save anywhere from $3,000 to over $50,000+ annually depending on their situation. The Credit for the Elderly alone ranges $3,750–$7,500. When combined with the Saver’s Credit ($1,000–$2,000), the new $6,000 senior deduction (worth $1,500–$1,800 in tax savings depending on tax bracket), and other credits, the cumulative benefit is substantial.

Q: What’s the difference between a tax credit and a tax deduction for seniors?

A: A deduction reduces your taxable income (e.g., a $6,000 deduction reduces taxable income by $6,000). A credit directly reduces your tax liability dollar-for-dollar (e.g., a $2,000 credit reduces your tax bill by $2,000). Credits are typically far more valuable. The new $6,000 senior bonus is a deduction, while the Credit for the Elderly is a credit the latter provides more direct benefit.

Q: Can I claim multiple tax credits in the same tax year?

A: Yes. Many credits can be combined for example, claiming both the Credit for the Elderly ($3,750–$7,500) and the Saver’s Credit ($1,000–$2,000) in the same year, plus the energy credit ($3,200 max), is entirely possible if you meet all income and eligibility requirements. However, some credits phase out at specific income levels, so consult a tax professional to verify your eligibility.

Q: Do I need to file a tax return to claim these credits?

A: Most credits require filing a federal tax return, typically Form 1040 or Form 1040-SR (the senior-specific form). Some credits are non-refundable (meaning you only benefit if you owe taxes), while others are refundable (you can receive money back even with zero tax liability). The Earned Income Credit and Premium Tax Credit are refundable; the Credit for the Elderly is not.

Q: What’s the best strategy for maximizing retirement tax credits?

A: Start with income planning keep your AGI low enough to qualify for income-limited credits (Credit for the Elderly, Saver’s Credit, Premium Tax Credit). Next, ensure you’re itemizing or taking the standard deduction plus the new $6,000 senior bonus. Finally, claim any education, energy, or dependent care credits you qualify for. Working with a CPA or enrolled agent who specializes in retirement taxation often pays for itself through strategic planning.