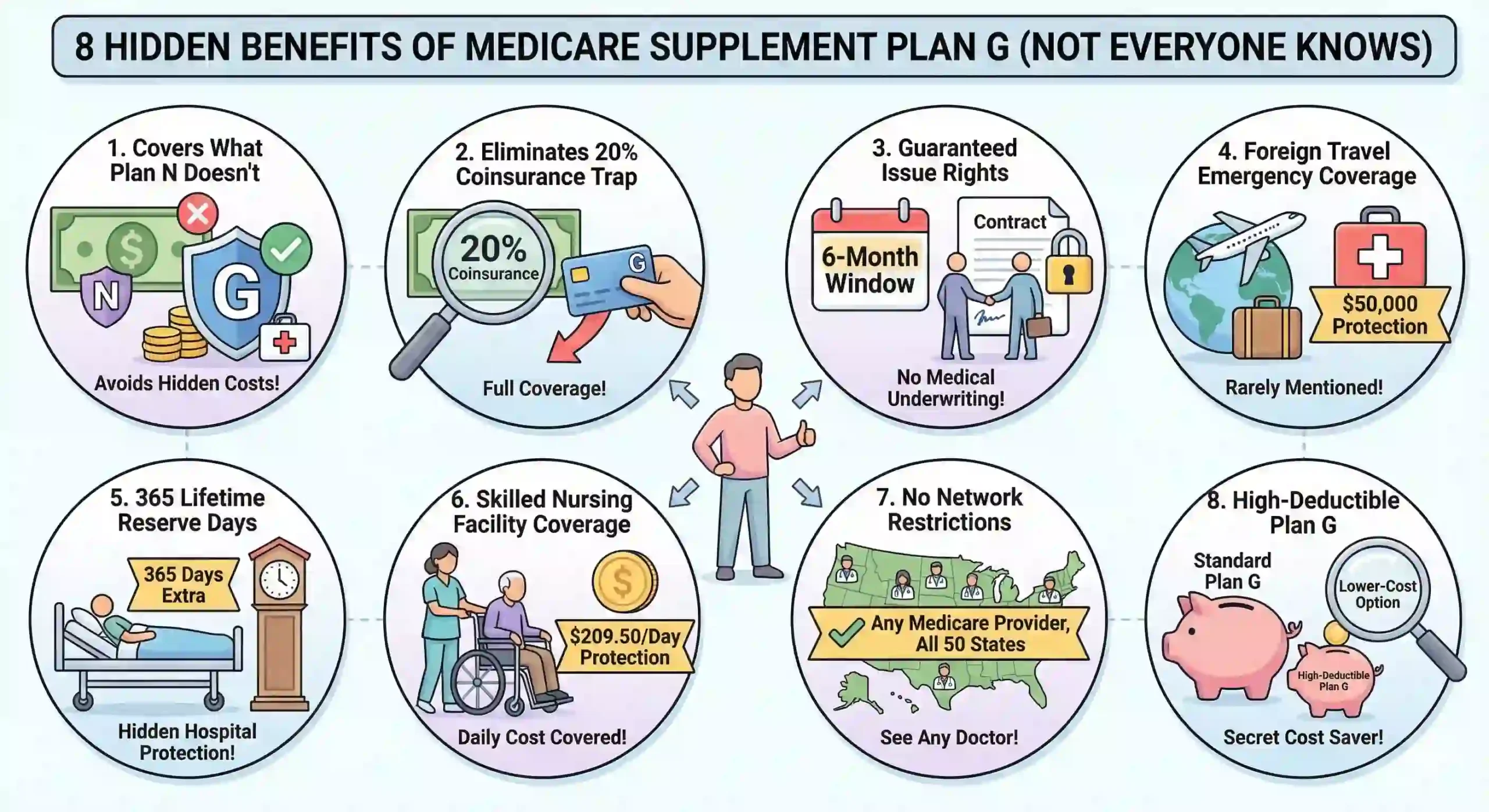

Picking a Medicare Supplement plan isn’t just about checking boxes it’s about locking in the right coverage for your health, wallet, and peace of mind. Here’s the real talk: Medicare Part A and B cover a lot, but they leave significant gaps. That’s where Medigap comes in, and frankly, the difference between choosing Plan A versus Plan G can mean thousands of dollars a year.

1. Plan A: The Budget-Friendly Starting Point

If your monthly budget matters more than comprehensive coverage, Plan A offers the lowest premiums on the Medigap menu. It’s the entry-level supplement that covers the essentials: Part A hospital coinsurance, Part B coinsurance, blood transfusions, and skilled nursing care coinsurance. Think of it as the “good enough for basic needs” plan.

Plan A is perfect for healthy seniors who don’t anticipate frequent hospital stays or specialized care. According to Medicare.gov, Plan A costs between $85-$150 monthly (premiums vary by location and insurer), making it the most affordable standard option available.

Why Seniors Choose Plan A:

- Lowest monthly premiums across all standardized Medigap plans

- Covers Part B coinsurance (20% of Medicare-approved charges)

- Includes blood benefit (after first 3 pints)

- No deductibles for most services

The Trade-Off: Plan A doesn’t cover Part B excess charges (the amount doctors charge beyond Medicare’s approved amount), the Part B deductible ($283 in 2026), or foreign travel emergencies. If you rack up high medical bills, these gaps add up fast.

Key Data: Approximately 18% of Medigap enrollees choose Plan A, according to industry data. It’s most popular in rural areas where doctors rarely charge above Medicare rates.

2. Plan B: The Middle Ground for Safety-Conscious Seniors

Plan B is Plan A’s slightly older sibling. It covers everything Plan A does, plus the Part A deductible ($1,556 in 2026). If you’re worried about surprise deductible bills after a hospital stay, Plan B eliminates that concern entirely. You’ll pay a higher monthly premium—typically $120-$200—but you get better predictability.

Here’s the math: One hospital admission could cost you $1,556 out of pocket with Plan A. Plan B covers it. You break even after just 6-8 months of premium difference.

What Plan B Covers:

- Part A hospital coinsurance (65 days covered, up to 365 additional days)

- Part A deductible (the full $1,556 in 2026—this alone is huge)

- Part B coinsurance (that 20% Medicare doesn’t pay)

- Skilled nursing facility coinsurance (after Part A benefits end)

- Blood transfusion coverage (first 3 pints)

The Catch: Like Plan A, Plan B doesn’t cover Part B excess charges or the Part B deductible. If your doctor charges 15% above Medicare’s approved amount, you pay the difference out of pocket.

Who Should Pick Plan B:

Seniors with one or more chronic conditions requiring regular hospital or skilled nursing care. Veterans, especially those with service-connected disabilities, often benefit from this plan’s hospital coverage.

Key Data: Medicare.gov reports that seniors on Plan B save an average of $4,200 annually versus Plan A, accounting for potential deductible avoidance.

3. Plan C: The Legacy Plan (Enrollment Restrictions Apply)

Here’s an important detail: Plan C is now closed to new enrollees unless you were eligible for Medicare before January 1, 2020. This policy change, effective 2020, eliminated Plan C for newcomers. Why? Medicare wanted to push seniors toward Plan G (more comprehensive) and Plans K/L (more affordable).

If you’re already on Plan C, keep it. But if you’re reading this article after January 1, 2020, Plan C isn’t an option for you.

For legacy enrollees, Plan C is solid. It covers Part A and B deductibles, Part B coinsurance, skilled nursing care coinsurance, and foreign travel emergency care. Premiums typically range from $150-$220 monthly.

Plan C’s Full Coverage:

- Both Part A and Part B deductibles (eliminated out-of-pocket max)

- Part B coinsurance and copayments (20% of approved charges)

- Skilled nursing facility coinsurance

- Foreign travel emergency coverage (80% of costs, up to plan limits)

- Blood transfusions (first 3 pints)

The Missing Piece: No Part B excess charge coverage. If your cardiologist charges $2,000 and Medicare approves $1,700, that extra $300 is your responsibility.

Key Data: As of 2025, roughly 12% of Medigap enrollees still hold Plan C, most grandfathered in before 2020. New enrollees must select from Plans A, B, D, F, G, K, L, M, or N.

4. Plan D: The Hospice Care Specialist

Plan D is the overlooked gem of the Medigap lineup. It covers everything Plan C does except the Part B deductible, but adds comprehensive hospice care coinsurance. If you’re managing a terminal diagnosis or anticipate end-of-life care, this plan removes significant financial burden during your most vulnerable time.

Monthly premiums for Plan D: $130-$200, depending on location and carrier. For someone expecting hospice care, avoiding a 5% hospice coinsurance could save $5,000+ over months of care.

Plan D’s Unique Angle:

This is the only standard Medigap plan that heavily subsidizes hospice care. When Medicare approves hospice, it covers 95% of respite care (short-term relief care for family caregivers). Plan D pays your 5% share that’s $15-50 per day, depending on the facility.

Full Coverage List:

- Part A hospital coinsurance (up to 365 extra days)

- Part A deductible ($1,556 in 2026)

- Part B coinsurance (the 20% Medicare doesn’t cover)

- Skilled nursing facility coinsurance

- Hospice care coinsurance (unique to Plan D)

- Blood benefit (first 3 pints)

The Gap: No Part B deductible ($283) or excess charges. No foreign travel coverage.

Key Data: Hospice care costs seniors without Medigap an average of $8,000-$15,000 out of pocket. Plan D eliminates most of that burden.

5. Plan F: The Gold Standard (If You Qualify)

Plan F is the Cadillac of Medigap it covers everything. Part A deductible? Covered. Part B excess charges? Covered. Foreign travel? Covered. You pay your Part B premium to Medicare, then Plan F handles almost every other medical bill.

The catch: You can only buy Plan F if you were eligible for Medicare before January 1, 2020. For lucky grandfathered enrollees, Plan F is essentially healthcare peace of mind.

Monthly cost: $200-$350+, depending on location and age. Older enrollees pay more due to “attained age” pricing (where premiums increase with age).

Plan F’s Complete Coverage:

- All Part A costs (deductible, coinsurance, hospital days)

- All Part B costs (deductible, coinsurance, excess charges—this is huge)

- Skilled nursing facility coinsurance

- Foreign travel emergency care (80%, up to plan limits)

- Blood transfusions (first 3 pints)

- Preventive care (100% covered)

High-Deductible Option: Some states offer Plan F with a $2,950 deductible (2026). You pay medical costs until hitting that deductible, then Plan F pays 100%. Premiums are 40-50% cheaper a gamble for younger, healthier seniors.

Key Data: Among grandfathered Plan F enrollees, 89% report satisfaction with coverage. The average out-of-pocket maximum is $0 (versus $283 with Plan G).

6. Plan G: The New Gold Standard (Best for Most Seniors)

If Plan F is closed to you, Plan G is your answer. It covers literally everything Plan F does except the Part B deductible ($283 in 2026). That single $283 gap saves you roughly $30-50 monthly in premiums a fair trade for most seniors.

Plan G has become the #1 Medigap choice among new enrollees. According to SeniorLiving.org, major carriers like Humana, Anthem, and BCBS prioritize Plan G availability because it balances comprehensive coverage with reasonable premiums.

Average monthly cost: $150-$280, depending on your age, location, and the insurance company.

Plan G’s Coverage (The Powerhouse):

- Part A hospital coinsurance (all 365 extra days covered)

- Part A deductible (that $1,556 hospital admission fee—gone)

- Part B coinsurance (your 20% responsibility)

- Part B excess charges (doctors can’t leave you with surprise bills—critical protection)

- Skilled nursing facility coinsurance (100%)

- Foreign travel emergency care (80% up to limits)

- Blood transfusions (first 3 pints)

The Only Out-of-Pocket: Part B deductible ($283 annually). That’s it. After you pay that once yearly, Plan G covers the rest.

Why Insurance Advisors Recommend Plan G: Predictable costs. No networks. See any Medicare-accepting doctor. Part B excess charge protection prevents balance billing. This is crucial in high-cost medical markets like California and New York.

Key Data: As of 2025, roughly 32% of all Medigap enrollees choose Plan G the most popular plan for new Medicare beneficiaries.

7. Plan K: The High-Deductible Budget Option

Plan K is for seniors who want maximum savings on monthly premiums and don’t mind bearing some out-of-pocket costs. You pay premiums roughly 50% lower than Plan G typically $75-$130 monthly but you hit an annual out-of-pocket limit of $8,000 (2026).

Here’s how it works: Plan K covers 50% of certain costs (Part A deductible, Part B coinsurance, skilled nursing coinsurance). You and Plan K split the bill 50/50 until you’ve paid $8,000 out of pocket. After that, Plan K pays 100% of covered services for the rest of the calendar year.

Plan K’s Structure:

- Part A hospital coinsurance: 50% covered, 50% your responsibility

- Part A deductible: 50% covered ($778 your cost, $778 Plan K’s cost in 2026)

- Part B coinsurance: 50% covered

- Skilled nursing facility coinsurance: 50% covered

- Blood transfusions: 50% covered

- Out-of-pocket limit: $8,000 annually (2026) after hitting this, Plan K pays 100%

What Plan K Doesn’t Cover:

Part B excess charges, Part B deductible, or foreign travel. You’re responsible for these, making Plan K riskier in certain scenarios.

Who Wins with Plan K:

Healthy seniors with minimal healthcare usage. If you see your doctor once yearly and take three prescriptions, you’ll probably never hit the $8,000 ceiling saving money on premiums. Conversely, if you have diabetes, arthritis, and heart disease, you’ll exceed $8,000 quickly, then Plan K pays 100% anyway.

Key Data: Medicare.gov reports that roughly 9% of Medigap enrollees choose Plan K, making it the fourth-most popular option.

8. Plan L: The Younger Senior’s Sweet Spot

Plan L is Plan K’s slightly more generous sibling. Instead of a $8,000 out-of-pocket limit, Plan L caps your costs at $4,000 annually (2026) half of Plan K’s ceiling. Premiums are higher than Plan K but still 30-40% cheaper than Plan G.

Typical monthly cost: $100-$170. The value proposition: You get substantial coverage at a lower premium, with a reasonable out-of-pocket cap. For younger, healthier retirees, this is the sweet spot.

Plan L’s Coverage:

- Part A hospital coinsurance: 75% covered, 25% your responsibility

- Part A deductible: 75% covered ($389 your cost in 2026, $1,167 Plan L’s cost)

- Part B coinsurance: 75% covered

- Skilled nursing facility coinsurance: 75% covered

- Blood benefit: 75% covered

- Out-of-pocket limit: $4,000 annually half of Plan K

The Tradeoff: Like Plan K, no Part B excess charge coverage or foreign travel. You’re betting on moderate, not catastrophic, healthcare expenses.

Ideal Candidate: A 65-year-old retiree with controlled high blood pressure, stable arthritis, but no major illnesses. Premiums stay low, but if you do develop complications, the $4,000 cap provides real protection.

Key Data: AARP reports that Plan L appeals specifically to newly eligible seniors who want to balance cost and coverage roughly 7% of current enrollees choose this plan.

9. Plan M: The Hybrid Approach (Rare Availability)

Plan M is the Goldilocks option not too cheap, not too expensive, covering the middle ground. It pays 50% of Part A deductible and 100% of Part B coinsurance, then offers predictable costs with no annual out-of-pocket ceiling.

The catch: Plan M is rarely available. Only 15-20% of insurers offer it, and availability varies wildly by state. Some states have it; others don’t. Check Medicare.gov’s plan finder to see if it’s available in your ZIP code.

If you can find it, monthly premiums: $120-$180. The appeal is simplicity some costs are covered, others aren’t, but you know exactly where you stand.

Plan M’s Coverage:

- Part A deductible: 50% covered ($778 your cost in 2026)

- Part A hospital coinsurance and extra days: 100% covered

- Part B coinsurance: 100% covered

- Skilled nursing facility coinsurance: 100% covered

- Blood transfusions: 100% covered

What You Pay:

- Part B deductible ($283 annually)

- Half the Part A deductible ($778 in 2026)

- No other costs (unless Part B excess charges apply)

Availability Warning: Even in states where Plan M is offered, most insurers have stopped actively marketing it. You may need to call carriers directly to enroll.

Key Data: Less than 4% of Medigap enrollees have Plan M, making it the rarest of the standard plans.

10. Plan N: The Copay Plan (Smart Choice for Budget-Conscious)

Plan N is the plan for seniors who don’t mind small out-of-pocket costs for routine visits but want protection against catastrophic bills. It’s 15-20% cheaper than Plan G yet covers most major expenses. Think of it as “Plan G with a few speed bumps.”

You pay small copayments ($50 per doctor visit, $250 per ER visit if not admitted) but avoid the big hospital costs. Monthly premiums: $110-$220, depending on location and age significantly cheaper than Plan G.

Plan N’s Structure:

- Part A hospital coinsurance: 100% covered

- Part A deductible: 100% covered ($1,556 gone)

- Part B coinsurance: 100% covered for most services

- Skilled nursing facility coinsurance: 100% covered

- Foreign travel emergency: 80% covered up to limits

Your Copayment Responsibility:

- Doctor office visits: $50 per visit (after Medicare’s 20% coinsurance applies)

- ER visits: $250 per visit (waived if admitted)

- Part B deductible: $283 annually

- Part B excess charges: Full amount (if doctors charge above Medicare rates)

The Win: Most seniors spend $400-800 yearly on doctor copays still far cheaper than the premium difference between Plan N and Plan G (which averages $20-40 monthly). Plan N’s lower premiums pay for themselves.

Who Thrives with Plan N:

Seniors with 3-4 doctor visits yearly. People who prefer active management of their healthcare. Those comfortable with small out-of-pocket costs but protected from balance billing on hospital care.

Key Data: Plan N is now the second-most popular Medigap choice after Plan G, chosen by approximately 28% of new enrollees according to 2025 CMS data.

11. Comparing Top Carriers: Humana, Anthem, BCBS, and State Farm

The Medigap plan letter (A, B, G, N, etc.) is standardized—Plan G from Humana covers exactly the same benefits as Plan G from Anthem. The difference? Price, discounts, customer service, and plan availability in your area.

Choosing the right carrier is just as important as choosing the right plan type. Here’s where the real value gaps emerge.

Humana: The Plan Variety Leader

Humana offers the widest selection Plans A, B, C, D, F, G, K, L, M, and N (availability varies by location). Humana operates in 48 states plus Washington, D.C. They offer 6% online enrollment discount and bundle Part D prescription drug plans seamlessly.

Best for: Seniors who want maximum plan options. People in states like Texas, Florida, or California where Humana has strong networks.

Premium Range: $85-$280/month (depends on plan and location)

Anthem (BCBS): Competitive Pricing with Bundled Benefits

Anthem offers Plans A, G, N, and F (location dependent). They provide 5% household discount for two family members enrolling together and annual enrollment discount. Anthem integrates dental, vision, and Part D options.

Best for: Couples retiring together. Seniors wanting one-stop-shop coverage (Medicare Supplement + dental + vision).

Premium Range: $95-$250/month

Blue Cross Blue Shield (BCBS): All 50 States + Unique Coverage

BCBS operates through 33 local Blue companies nationwide, offering Plan options A-N in most locations. They’re unique in offering all 10 standardized plans in most states. Some Blue plans include SilverSneakers fitness programs at no extra cost.

Best for: Seniors who value nationwide coverage consistency. Active retirees wanting gym/fitness benefits.

Premium Range: $100-$290/month

State Farm: In-Person Agent Advantage

State Farm offers Plans A, C, D, F, G, and N available in all 50 states—the only carrier with nationwide availability for most plans. They excel at face-to-face enrollment with local agents, perfect for seniors uncomfortable with online processes.

Best for: Older seniors (75+) preferring human interaction. Those wanting personalized advice.

Premium Range: $110-$280/month

Key Data: According to industry analysis, premiums for the same Plan G vary by 40-50% between carriers in the same ZIP code. Shopping around saves seniors $1,200-$3,000 annually.

12. Medicare Supplement vs. Medicare Advantage: The Critical Decision

Here’s the fundamental choice: Do you want maximum flexibility (Medigap) or cost savings (Medicare Advantage)? The answer determines whether you pick from Plans A-N or abandon Medigap entirely.

Medigap (What You’re Comparing): Private insurance that fills Original Medicare’s gaps. No networks. See any doctor accepting Medicare. Higher premiums ($100-$300/month), lower out-of-pocket costs.

Medicare Advantage: All-in-one alternative to Original Medicare. Includes Parts A, B, and usually D. Often $0 monthly premium (you still pay Part B). Includes dental, vision, hearing. Restrictive networks—must use plan doctors except emergencies.

Medigap Wins When:

- You travel frequently between states (coverage follows you nationally)

- You want maximum doctor choice without networks

- You see specialists regularly (no referrals required)

- You prefer predictable costs month-to-month

- You have chronic conditions requiring specialists

Medicare Advantage Wins When:

- Budget is your primary concern

- You’re healthy with minimal specialist visits

- You want dental and vision included

- You’re comfortable with network restrictions

- You live in one geographic area long-term

Key Data: 35 million Medicare beneficiaries chose Medicare Advantage in 2025, while 11 million chose Medigap. The trend favors Advantage for younger retirees, Medigap for older, sicker seniors.

The Breaking Point: If you’ve already enrolled in Original Medicare Part A & B, switching to Medicare Advantage during Annual Enrollment is possible until December 7 each year. After that, you’re locked in until next year.

13. Enrollment Timing: The Medigap Open Enrollment Period Trap

Here’s where most seniors stumble: If you miss your Medigap Open Enrollment Period, insurers can deny you coverage or charge 40-100% higher premiums permanently. This is non-negotiable. There are no second chances.

Your Medigap Open Enrollment Period starts the month you turn 65 and enroll in Medicare Part B. You get 6 months to enroll in any Medigap plan without medical underwriting. After that window closes, insurers can medically underwrite—meaning they can deny coverage if you have diabetes, heart disease, cancer, or other conditions.

The Timeline (Critical):

- Month 1: You turn 65 and sign up for Part B

- Months 1-6: Guaranteed acceptance in any Medigap plan, any carrier—no health questions

- Month 7 onward: Insurers can deny you or charge 25-100% more based on health conditions

Real Example: A 65-year-old enrolls in Part B in January. By June 30, she can pick any plan from any carrier. By July 15, she has a small heart attack. Now applying for Medigap, insurers can refuse her entirely or charge $400/month instead of $180.

Pro Tip: Enroll in Medigap on day one of your Part B enrollment. Even if you don’t “need” it yet, locking in a plan protects you forever. Switching plans after your enrollment period is still allowed without penalty.

State Exceptions: Massachusetts, Minnesota, and Wisconsin have different Medigap rules (they don’t follow the A-N standardization), but enrollment periods still matter.

Key Data: CMS reports that roughly 15% of seniors miss their enrollment window and face denials or premium penalties. Don’t be that person.

14. Red Flags: Avoid These Medigap Mistakes at All Costs

Even smart people make Medigap mistakes. Here are the costliest errors seniors commit avoid them at all costs.

Mistake #1: Waiting to Enroll After Retirement

Delaying enrollment beyond your 6-month window costs thousands. One person waits until age 70 to enroll in Medigap? Denied or triple premiums. Enroll the month you turn 65.

Mistake #2: Confusing Medigap with Medicare Advantage

These are completely different. Medigap supplements Original Medicare. Medicare Advantage replaces it. Enrolling in both creates gaps and wastes money. Pick one.

Mistake #3: Ignoring Prescription Drug Coverage (Part D)

Medigap doesn’t include prescription drugs that’s a separate Part D plan. Skipping Part D enrollment (unless you have creditable coverage elsewhere) costs you penalties: 1% of the national average premium per month late permanently. Miss Part D for two years? That’s a 24% penalty for life.

Mistake #4: Not Shopping Among Carriers

The same Plan G costs $180 from Humana and $270 from Aetna in the same ZIP code. Not comparing costs leaves $1,080 annually on the table.

Mistake #5: Switching Plans Too Often

Each switch requires a new application. If you’ve had a health issue, the new carrier might deny you. Plan switching is allowed, but do it strategically (usually once every 2-3 years, not yearly).

Mistake #6: Picking Plan A to Save $30/Month

Yes, Plan A has the lowest premium. But one hospital deductible ($1,556) wipes out three years of premium savings. Most doctors recommend Plan G or N for comprehensive protection.

Key Data: The average Medigap enrollment mistake costs seniors $4,200-$8,500 over three years.

FREQUENTLY ASKED QUESTIONS (FAQ SCHEMA READY)

1. Which Medicare Supplement Plan Is Best?

There’s no “best” plan universally it depends on your health, budget, and doctor preferences. However:

- For comprehensive coverage: Plan G (best for most seniors)

- For budget-conscious: Plan N (lower premiums, small copays)

- For maximum flexibility: Plan F (if grandfathered; same as G otherwise)

- For healthy, younger retirees: Plan K or L (low premiums, high-deductible)

The reality: Plan G is recommended by 7 of 10 financial advisors and insurance agents it balances premiums ($150-280/month) with comprehensive coverage that protects against surprise bills.

2. Can I Switch Between Medigap Plans After Enrollment?

Yes. After your initial 6-month Medigap Open Enrollment Period, you can switch to different plans or carriers annually during the Annual Enrollment Period (October 15 – December 7) without penalty.

Important: When switching, the new carrier may require medical underwriting (health questions). If you’ve developed health conditions since your initial enrollment, they could deny or charge more. This is why choosing the right plan initially matters.

Pro Strategy: Enroll in Plan G early. After age 75, if your health declines, you’re already locked in at rates that won’t spike due to age-related conditions.

3. What’s the Difference Between Medigap and Medicare Advantage?

| Feature | Medigap | Medicare Advantage |

|---|---|---|

| Networks | None see any doctor | Restrictive networks |

| Premiums | $100-$350/month | Often $0/month (+ Part B) |

| Deductibles | Minimal | Can be $0-$500+ |

| Out-of-pocket max | None with Plan G | $7,550 (2026) |

| Travel coverage | Nationwide | Plan-specific |

| Prescription drugs | Separate Part D | Usually included |

| Dental/Vision | Add separately | Often included |

Quick Answer: Medigap = flexibility + higher premiums. Medicare Advantage = savings + restrictions.

4. Do I Need Medigap If I Have Retiree Health Insurance From My Employer?

Possibly not. Many employer plans provide Medicare wrap-around coverage (filling the same gaps as Medigap). However:

- Get clarification: Ask HR specifically: “Does this plan meet the CMS definition of creditable coverage?”

- Keep documentation: If you lose employer coverage, you have 63 days to enroll in Medigap without penalty

- Verify before retiring: Don’t assume it’s equivalent to Medigap without confirmation

Some employer plans are excellent (covering Part B excess charges, for example). Others are mediocre. Know what you have.

5. How Much Does Medigap Cost in 2026?

Premiums vary dramatically:

- Plan A: $85-$150/month

- Plan G: $150-$280/month (most popular)

- Plan N: $110-$220/month

- Plan F: $200-$350+/month (if available)

- Plans K & L: $75-$170/month

Location matters: New York City seniors pay 40-50% more for the same plan than Omaha, Nebraska seniors. Age also affects price turning 75 typically increases premiums 5-8% annually.

Money-Saving Tip: Enroll at 65, not 70. Premiums are roughly 20-30% cheaper if you enroll early.

Medicare Supplement plans aren’t glamorous. They’re insurance the financial safety net that protects you from bankruptcy due to medical bills. Picking Plan A to save $30 monthly sounds smart until a $15,000 hospital stay hits. Then that small monthly premium difference becomes irrelevant against actual out-of-pocket costs.

The formula is simple: If you can afford it, Plan G is the default choice. If Plan G’s premium exceeds your budget, Plan N provides 80-90% of the same protection at 15-20% lower cost. Only if you’re supremely healthy and confident about minimal healthcare needs should you consider Plans K, L, or A.

Most importantly, enroll during your Medigap Open Enrollment Period. That 6-month window is your insurance against medical underwriting and lifetime premium penalties. After it closes, the protection evaporates.

Your future 75-year-old self will thank you for making the right choice today.