Social Security feels simple on the surface: work, pay in, collect a check. The reality is a maze of rules, penalties, and hidden opportunities that can add or subtract tens of thousands of dollars over your lifetime.

Most retirees don’t need a PhD in Social Security, but they do need to know a few crucial rules that determine how big their monthly check is, how much tax they pay, and what their spouse will receive if they die first.

1. Your Claiming Age Can Change Your Lifetime Benefits by Six Figures

Starting Social Security at 62 is easy and tempting. The problem? For most healthy retirees, it’s one of the most expensive financial decisions they’ll ever make. Claiming early doesn’t just shrink your monthly check; it often slashes your lifetime payout if you live into your 80s or 90s.

- Claim at 62: Your monthly benefit can be cut by up to 30% compared with your Full Retirement Age (FRA), depending on your birth year.

- Claim at FRA (66–67): You receive 100% of your Primary Insurance Amount (PIA) the baseline benefit you’ve earned.

- Wait to age 70: You gain delayed retirement credits of about 8% per year after FRA, boosting your check by up to 24–32%.

Here’s the rough math: If your FRA benefit is $2,000 per month, claiming at 62 might cut it to around $1,400, while waiting until 70 could raise it to roughly $2,480. Over a long retirement, that gap can easily exceed $150,000 in total benefits. The “best” age depends on your health, family longevity, and other income sources but the stakes are much bigger than most people realize.

2. The Earnings Limit Can Quietly Cut Your Check Before Full Retirement Age

Plenty of retirees want the best of both worlds: start Social Security early and keep working. That can work, but there’s a catch almost nobody talks about the earnings test, a rule that temporarily withholds benefits if you earn “too much” before your Full Retirement Age.

Here’s how the 2025 limits work for people under FRA while receiving benefits:

- Under FRA all year:

- Annual earnings limit: $23,400 in 2025 (about $1,950 per month).

- You lose $1 in benefits for every $2 you earn above that.

- Reaching FRA during 2025:

- Higher limit: $62,160 in earnings before the month you hit FRA.

- You lose $1 in benefits for every $3 over that amount.

The good news: this money isn’t gone forever. Once you reach FRA, the Social Security Administration (SSA) recalculates your benefit and gives you credit for the months they withheld. Still, if you’re considering filing early while working, it’s crucial to run the numbers. Earning just $10,000 over the limit could mean $5,000 in temporarily lost benefits.

3. Up to 85% of Your Social Security Can Be Taxed Even After the 2025 Tax Act

Many retirees heard rumors that new tax laws made Social Security “tax-free.” That’s simply not true. The 2025 Tax Act did NOT change the federal tax rules on Social Security benefits. If your income is high enough, up to 85% of your benefit can be subject to federal income tax.

The IRS looks at your “provisional income” (basically AGI + tax-exempt interest + half of your Social Security) and applies thresholds that haven’t changed for decades:

- Single filers:

- Above $25,000: up to 50% of benefits taxable.

- Above $34,000: up to 85% taxable.

- Married filing jointly:

- Above $32,000: up to 50% taxable.

- Above $44,000: up to 85% taxable.

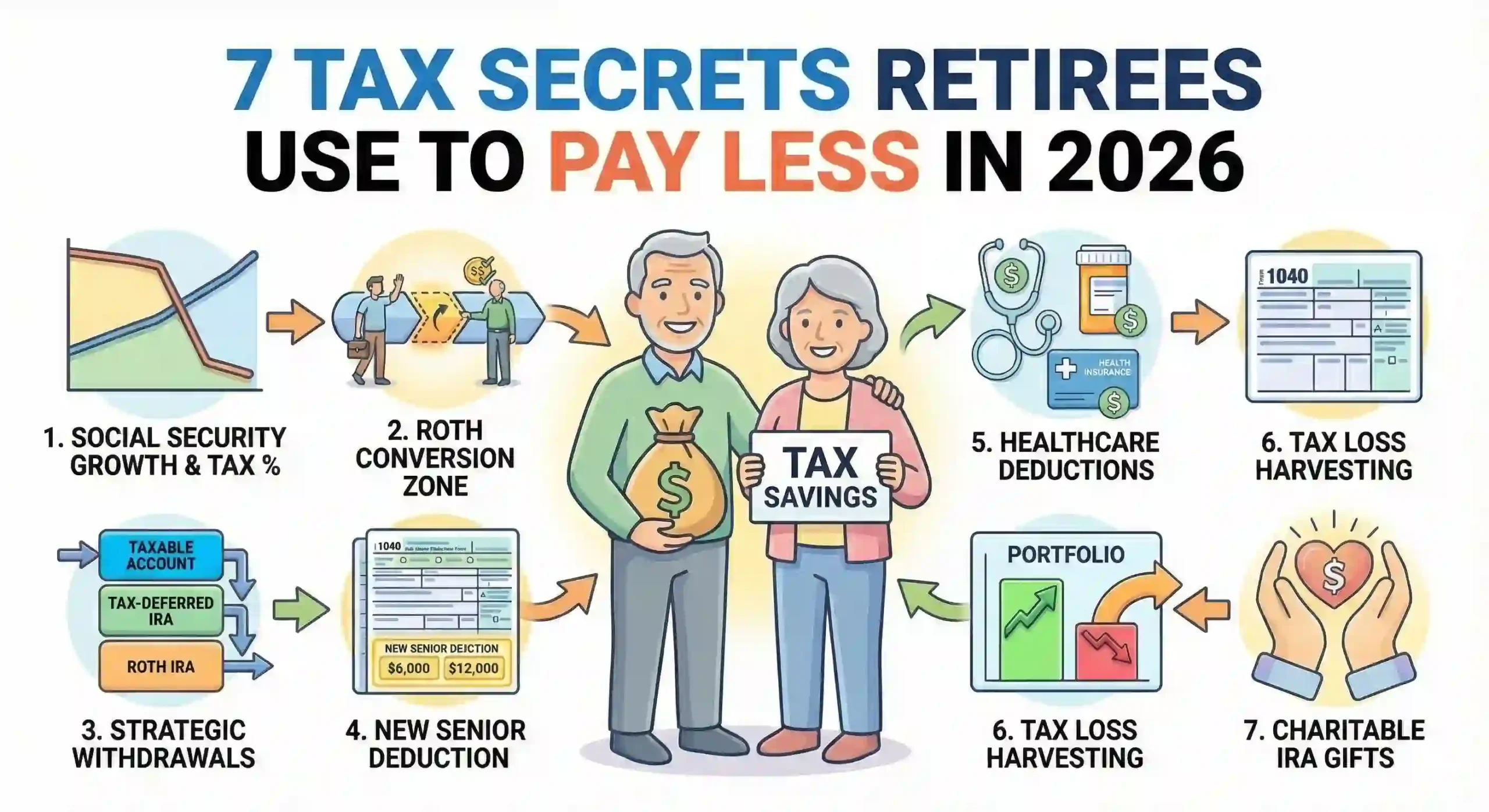

The 2025 law added a separate temporary senior deduction of $6,000 (single) or $12,000 (joint) for those 65+ but that’s on top of the standard deduction and does not cancel Social Security taxes. If you convert $100,000 from a 401(k) to a Roth in one year, that extra income can easily push more of your Social Security into the taxable zone. Tax planning matters just as much as claiming strategy.

4. Spousal Benefits Can Give Your Household a 50% Boost If You Follow the Rules

One of the most overlooked Social Security rules is how spousal benefits work. A non‑working or lower‑earning spouse may be able to claim up to 50% of the higher earner’s benefit, which can dramatically raise the household’s monthly income. The trick is knowing the rules and timing.

Key spousal benefit rules, according to SSA guidance and financial planners:

- Up to 50% of PIA: At FRA, a spouse can receive 50% of the worker’s Primary Insurance Amount, not 50% of a delayed age‑70 benefit.

- Worker must file first: The higher‑earning spouse generally must have claimed their own benefit before the other can claim a spousal benefit.

- Early spousal filing = permanent reduction: Claiming a spousal benefit at 62 can permanently lower it below the 50% maximum.

Example: If your spouse’s PIA is $2,200, the maximum spousal benefit at FRA is $1,100. But if you claim at 62, your spousal check could be reduced by roughly 30–35% for life. Also, spousal benefits do not earn delayed retirement credits past FRA, so there’s no reward for waiting beyond that point. Couples who coordinate both benefits can easily add tens of thousands of dollars to their total lifetime payout.

5. Divorced? You Might Still Qualify for up to 50% of an Ex’s Benefit

A surprising number of divorced retirees never realize they’re leaving money on the table. If you were married long enough and your ex had higher earnings, you may qualify for divorced spousal benefits even if your ex has remarried and even if you haven’t spoken in years.

Here are the basic SSA rules most people miss:

- 10-year rule: You must have been married to your ex for at least 10 years.

- Current marital status: You must be unmarried now to claim on an ex’s record.

- Age requirement: You can apply as early as 62, but claiming before FRA permanently reduces the benefit.

- No impact on your ex: Their benefit amount and their current spouse’s benefit are not reduced by your claim.

If your own retirement benefit at FRA would be $900, and your ex’s PIA is $2,400, you might qualify for up to $1,200 (50% of your ex’s PIA) instead. SSA will automatically pay you whichever is higher your own benefit or the divorced spousal amount. With the right paperwork and timing, this rule can be worth hundreds of dollars per month, every month.

6. Survivor Benefits Can Be Worth Up to 100% of a Late Spouse’s Check

Survivor benefits are one of the most important and misunderstood pieces of Social Security planning. If your spouse passes away first, you may be able to step up to as much as 100% of their benefit, depending on their claiming age and yours. This is a big reason why it can make sense for the higher earner to delay benefits.

Key survivor benefit points to know:

- Up to 100% of deceased spouse’s benefit: If your spouse claimed at or after FRA, you might receive their full benefit as a survivor. If they claimed very early, your survivor benefit will be lower.

- Age rules: Widows and widowers can generally claim reduced survivor benefits as early as age 60 (or 50 if disabled). Waiting closer to FRA increases the percentage.

- Survivor vs. own benefit: You can sometimes switch between your own retirement benefit and survivor benefits a strategy that can add tens of thousands over a lifetime.

Also Read : 15 Ways to Maximize Social Security Without Working Longer

Example: Suppose your own benefit is $1,200 and your late spouse’s benefit was $2,600. As a survivor at FRA, you may step up to roughly $2,600 per month, more than double your previous check. For couples, one of the most powerful “hidden” strategies is letting the higher earner delay to age 70, protecting the surviving spouse with the largest possible survivor benefit.

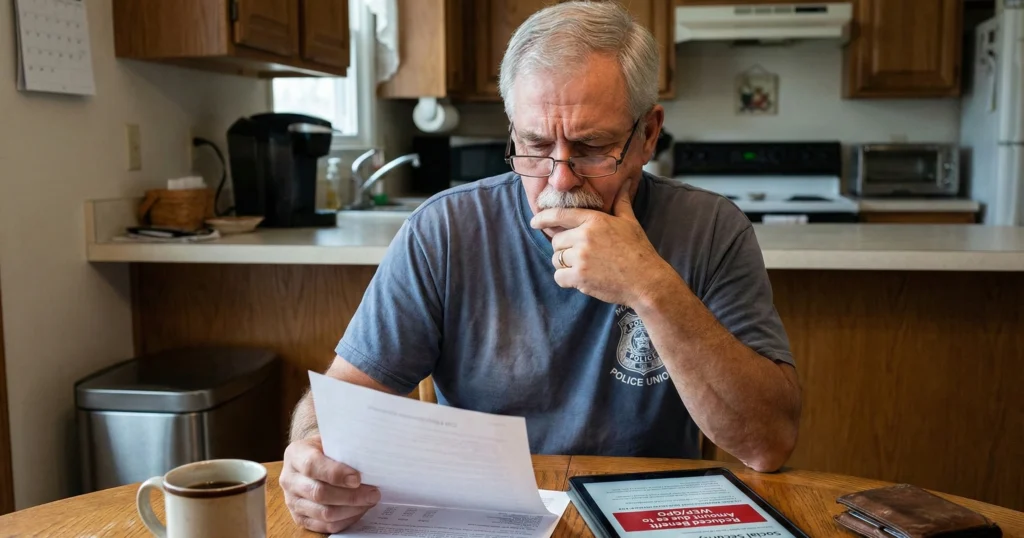

7. Working for a Government or Non Social Security Job? Special Rules Can Shrink Your Check

If you spent part of your career in a job that did not withhold Social Security taxes such as certain teachers, police officers, or other government workers your benefits can be reduced by two little-known rules: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These rules stop people from “double dipping,” but they also surprise many retirees.

Here’s what they do in practice:

- WEP (Windfall Elimination Provision):

- Applies if you receive a pension from “non‑covered” work and also qualify for Social Security from other jobs.

- Can reduce your own retirement benefit by up to half of your pension, capped at a maximum WEP reduction (often around a few hundred dollars per month).

- GPO (Government Pension Offset):

- Applies to spousal or survivor benefits if you have a non‑covered government pension.

- Can reduce those benefits by two-thirds of your government pension sometimes wiping them out completely.

In early 2025, SSA began adjusting payments for people impacted by WEP and GPO as part of the Social Security Fairness Act changes and litigations. If you taught for 20 years in a non‑covered district and later worked in the private sector, you need a personalized estimate from SSA before you assume you’ll get the full “headline” benefit that online calculators show.

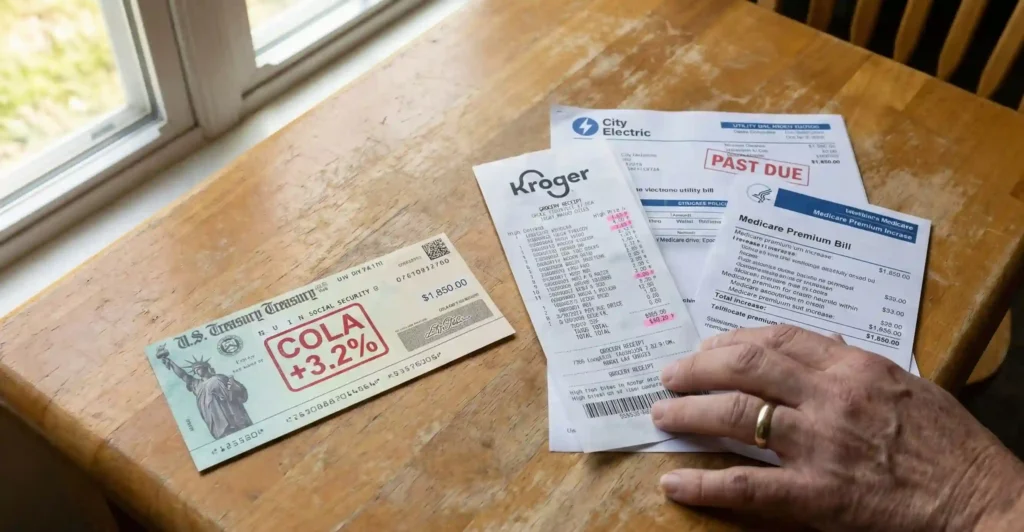

8. Your COLA Increase Isn’t a Raise If Medicare and Inflation Eat It

Every fall, Social Security announces a cost-of-living adjustment (COLA). In theory, it keeps your benefits aligned with inflation. In practice, many retirees feel like their raise disappears as soon as their Medicare premium and grocery bill arrive. For 2025, the COLA is about 3.2%, worth roughly $50–$60 more per month for the average retiree.

Here’s why that bump doesn’t always feel like a raise:

- Medicare Part B premiums: These often go up in the same year, automatically deducted from your check. A $20–$30 premium hike can swallow half your COLA.

- Inflation math: COLA is based on an index (CPI‑W) that doesn’t perfectly reflect retiree spending, especially healthcare, which can rise faster than the official CPI.

- Higher tax exposure: A COLA can push more of your Social Security into the taxable category or increase your IRMAA surcharges for Medicare if your income crosses certain thresholds.

If your 2024 benefit was $1,800, a 3.2% COLA raises it to roughly $1,858 an extra $58 per month. If your Medicare costs rise by $20 and other prices eat up $30–$40, your “raise” effectively vanishes. The takeaway: COLA is helpful, but it’s not a complete inflation shield. You still need savings, investments, or part‑time income to protect your long‑term purchasing power.

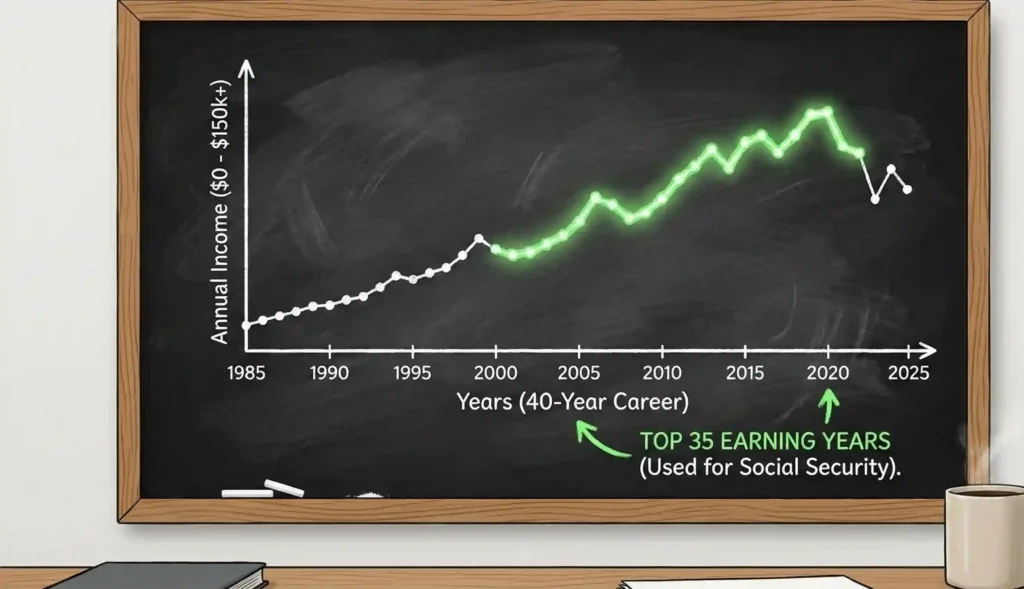

9. Your 35 Highest-Earning Years and Income Cap Decide How Big Your Check Can Get

Social Security isn’t based on your last salary or your best three years. It’s based on your highest 35 years of inflation‑adjusted earnings. That one rule explains why working a few extra years or filling in low-earning years can quietly boost your check for the rest of your life.

Here’s how the formula really works:

- SSA indexes your earnings for inflation and picks your highest 35 years of covered wages.

- Those earnings are averaged into an Average Indexed Monthly Earnings (AIME) number.

- A progressive formula converts your AIME into your Primary Insurance Amount (PIA) at FRA.

In 2025, only income up to $176,100 is subject to Social Security payroll tax and only those earnings count toward your benefit calculation. If you have fewer than 35 years of earnings, SSA plugs in zero‑income years, dragging your average down. That means one late‑career job at $80,000 replacing a “zero year” could raise your benefit for the rest of your life. For high earners, consistently earning near the taxable maximum can produce a top FRA benefit of around $4,018 per month in 2025.

Frequently Asked Questions About Social Security Rules for Retirees

Q1. When is the best age to start Social Security?

There’s no one-size-fits-all age. If you’re in poor health or need income immediately, starting at 62 can make sense, but you’ll lock in a permanent reduction of up to 30% compared with your Full Retirement Age. Waiting until FRA (66–67) gives you 100% of your PIA, and delaying to 70 can raise your check by about 8% per year after FRA, up to roughly 24 32% more than claiming at FRA. Think in terms of break-even: if you expect to live beyond your late 70s or early 80s, waiting often wins over the long run.

Q2. Can I work and collect Social Security at the same time?

Yes, but if you’re under your Full Retirement Age, the earnings limit applies. In 2025, you can earn up to $23,400 without impacting your check. Above that, Social Security withholds $1 for every $2 you earn. In the year you reach FRA, the limit jumps to $62,160, and only $1 for every $3 is withheld over that amount. After the month you hit FRA, there’s no earnings limit you can work and earn as much as you want, and SSA later recalculates your benefit to give you credit for withheld months.

Q3. Are Social Security benefits really taxable?

They can be. For federal taxes, up to 85% of your Social Security benefits can be included in taxable income if your provisional income crosses certain thresholds $25,000/$34,000 for single filers and $32,000/$44,000 for married couples filing jointly. The 2025 Tax Act added a separate senior deduction, but it did not eliminate Social Security taxation. Some states tax benefits, some don’t, so it’s worth checking your state’s rules or talking with a tax professional.

Q4. How do I know if I qualify for spousal or divorced spousal benefits?

For spousal benefits, your spouse must have filed for their own benefit, you must generally be at least 62, and the maximum is 50% of your spouse’s PIA at your FRA. For divorced spousal benefits, you usually must have been married at least 10 years, be currently unmarried, and have an ex who is entitled to Social Security retirement or disability benefits. SSA will compare your own benefit and your spousal or divorced spousal benefit and pay the higher of the two. A quick conversation with SSA or a fee-only planner can confirm which rules apply to your situation.