Social Security optimization looks simple on the surface file when you hit 62 and pocket your benefits, right? Wrong. The real strategy is hidden in a maze of rules, timing windows, and spousal combinations that most people never exploit. This guide breaks down the 15 most effective methods to unlock thousands in additional lifetime income, all without adding another decade of hustle to your career.

1. Delay Your Claim Until Age 70 (The 8% Annual Raise)

Most Americans grab Social Security at 62 and instantly lock in a 30% permanent benefit cut. But there’s a government-backed 8% annual raise waiting if you can afford to delay.

Here’s how the math works:

- Claim at 62? $1,800/month = $21,600/year ($518,400 lifetime at 85)

- Claim at 67 (Full Retirement Age)? $2,700/month = $32,400/year ($648,000 lifetime)

- Claim at 70? $3,600/month = $43,200/year ($734,400 lifetime)

The Secret: Each year you wait past Full Retirement Age (FRA currently 66-67 depending on birth year), the SSA automatically adds 8% to your benefit. This is called Delayed Retirement Credits (DRC), and it’s the closest thing to a risk-free investment the government offers. No taxes, no market volatility, no fees.

Who should do this:

- You have $50,000+ in retirement savings to live on (pension, 401k, IRA)

- Family history suggests you’ll live past 80 (longevity factor)

- You’re the higher earner in a married couple (spousal benefits multiply)

The Catch: If you claim at 62 but live past 80, you’ll regret it. The “break-even” age is typically 80-82. If you’ll likely see 85+, waiting is mathematically superior.

2. Coordinate Spousal Strategies (The Double-Dip Loophole)

Married couples can claim up to 50% of the higher earner’s benefit based on their spouse’s work record even if the lower earner never worked a day. This strategy alone can add $200K+ in lifetime benefits.

How it works:

- Spouse A earns $120,000/year for 35 years → Primary Insurance Amount (PIA) = $2,700/month

- Spouse B earned $30,000/year → PIA = $800/month

- Traditional claiming: $2,700 + $800 = $3,500/month total

Optimized spousal strategy:

- Spouse A delays until 70 → Gets $3,600/month

- Spouse B claims spousal benefit at FRA → Gets 50% of A’s FRA amount = $1,350/month

- New total: $3,600 + $1,350 = $4,950/month (+$420/month vs. traditional)

Critical Rules:

- The lower-earning spouse MUST wait until Full Retirement Age to claim the full 50% spousal benefit

- If you claim spousal benefits before FRA, the benefit is reduced (typically 32.5% instead of 50%)

- You must be married for at least 2 years (1 year if you’re receiving government pension)

- Spousal benefits end if the higher earner passes away (survivor benefits take over)

The Modern Catch: The “File and Suspend” strategy (claiming at FRA and letting benefits grow while taking spousal benefits) was eliminated in 2015. You can’t use it anymore if you were born after January 2, 1954. Check your birth year before planning.

3. Divorce Strategically (The Ex-Spouse Benefit)

You don’t need to be currently married to claim spousal benefits. If you were divorced after at least 10 years of marriage, you can claim up to 50% of an ex-spouse’s benefit without their knowledge or permission (the SSA doesn’t notify them).

The Numbers:

- Your PIA = $1,200/month

- Ex-spouse’s PIA = $2,800/month

- Spousal benefit available = 50% of $2,800 = $1,400/month

- Your total at FRA: $2,600/month ($1,200 + $1,400 spousal) vs. your $1,200 solo benefit

- Lifetime gain (to age 85): $480,000 extra

The Fine Print:

- You must be at least 62 to claim

- You must have been divorced for at least 2 years (unless your ex is already claiming)

- You must be unmarried at the time of claim

- The ex-spouse must be at least 62 (whether or not they’ve claimed)

- You can claim MULTIPLE ex-spouses’ benefits if you were married 10+ years to more than one person

Real-World Edge Case: If you have 3 ex-spouses (married 10+ years each), you could theoretically claim spousal benefits from ALL THREE applying for the highest benefit first, then layering on additional ex-spousal claims. The SSA system will calculate the combined amount (though each claim requires a separate application).

4. Monitor Your Earnings Record (Correct Hidden Errors)

The Hook: The SSA makes clerical mistakes. Roughly 30 million earnings records contain errors, and many go undiscovered for decades. A single misreported year could cost you $10,000+ in lost benefits.

What goes wrong:

- Employer reports wrong Social Security number (similar number off by one digit)

- Self-employment income not properly credited

- Wage data from multiple jobs merged into one entry

- Tax withholding corrections entered late (after benefit calculation)

Example of Hidden Cost:

- You earned $45,000 in 2010 but SSA records show $35,000

- Difference = $10,000 annually

- Over 35 years of benefit calculation = -$286 per month reduction

- Lifetime cost: $85,800 (if you live to 85)

Action Steps:

- Create a “My Social Security” account at ssa.gov/myaccount

- Print your complete earnings history (shows all years on record)

- Compare against your tax returns and W-2 forms

- Look for any year where earnings are LOWER than expected

- If errors exist, request a Form SSA-7008 (Request for Earnings Record Change)

- Must be done within 3 years, 3 months, and 15 days of the year earned

Critical Detail: Corrections can INCREASE your benefit by thousands, but only if filed before you claim. Once you start benefits, corrections are limited.

5. Work Part-Time While Claiming (Replace Low-Income Years)

Your Social Security benefit is calculated on your highest 35 years of earnings. If you have fewer than 35 years worked, “zero years” (years with $0 income) are included in the calculation, automatically reducing your benefit by 2-3%.

The Math:

- You worked 30 years (highest year: $60,000)

- 5 “zero years” are included in calculation

- Average of 35 years ≈ $51,428

- Now, if you work 1 more year earning $50,000:

- New average ≈ $52,142

- Benefit increase ≈ $15-30/month

BUT here’s the real advantage: If you can replace a LOW-EARNING year (say, you earned $20,000 in 1998) with a HIGHER-EARNING year today:

- Example: Replace $20,000 year with $60,000 year

- Benefit increase: $100-150/month

- Lifetime gain (to 85): $36,000+

Earnings Limits While Claiming (2026):

- If you claim BEFORE Full Retirement Age AND work: $1 in benefits withheld for every $2 earned over $23,400/year (2025; amounts adjust annually)

- After reaching FRA in the claim year: $1 withheld for every $3 earned over $62,160 (only applies until FRA month)

- After FRA: NO earnings limit—work as much as you want with no penalty

Pro Strategy: Claim at FRA or later to avoid earnings penalties entirely. If you claim at 62, any work income effectively erases your benefit for that year.

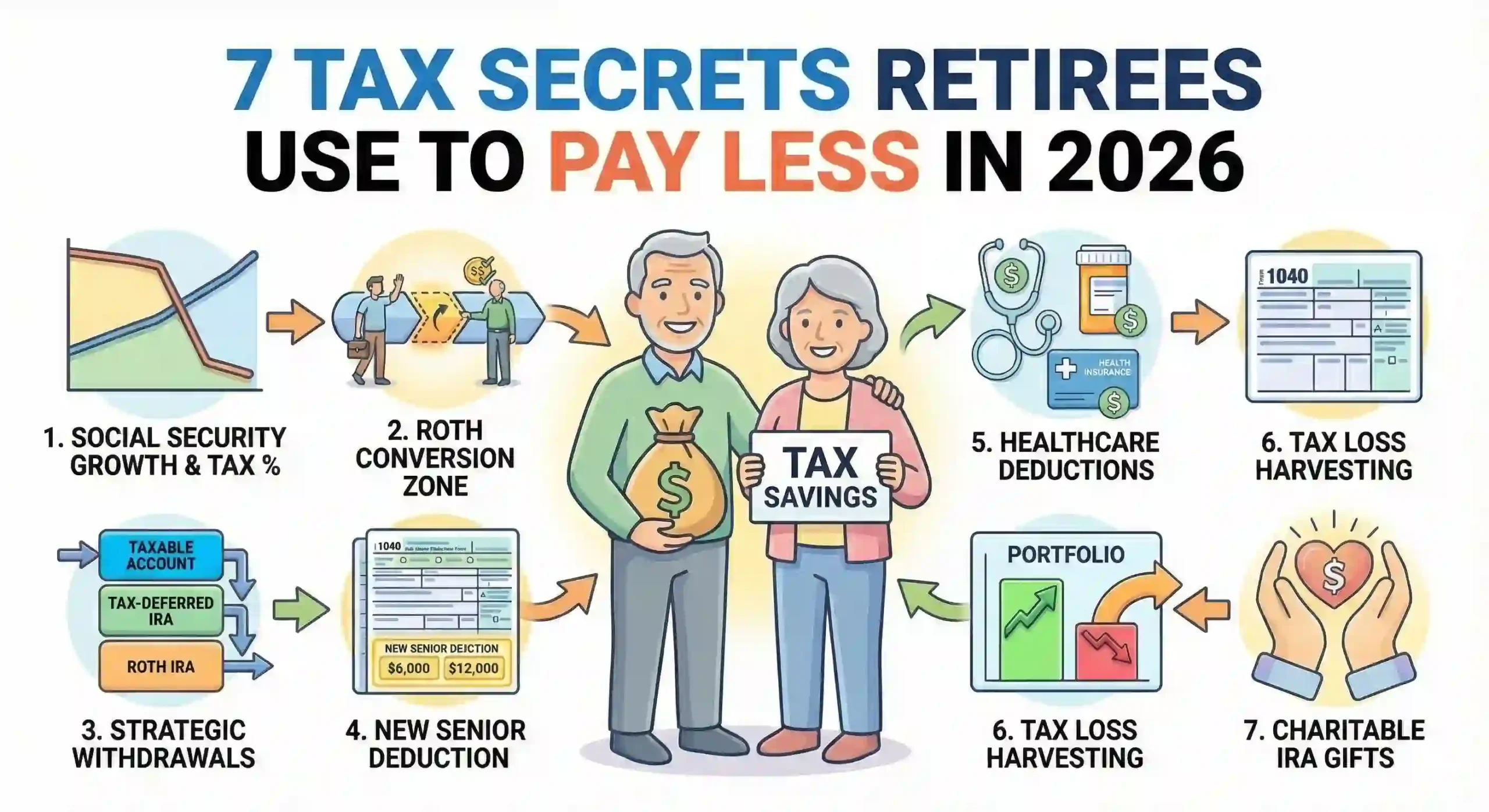

6. Minimize Social Security Tax (The 85/50 Rule)

Up to 85% of your Social Security benefits can be taxed as income depending on your “Combined Income.” A strategic withdrawal plan can reduce this tax to 0%.

How “Taxation of Benefits” Works:

Your “Combined Income” = Your Adjusted Gross Income + Tax-Exempt Interest + 50% of Social Security Benefits

Tax brackets for 2026:

- Single filers: If Combined Income > $34,000, you’ll pay tax on some benefits

- Married filing jointly: If Combined Income > $44,000, you’ll pay tax on some benefits

- Up to 50% of benefits can be taxed (if C.I. is slightly above threshold)

- Up to 85% of benefits can be taxed (if C.I. is significantly higher)

Example:

- Social Security benefit: $2,000/month = $24,000/year

- Pension income: $25,000/year

- Investment income: $15,000/year

- Combined Income = $25,000 + $15,000 + (50% × $24,000) = $52,000

- Result: 85% of benefits taxable = $20,400 taxable (federal income tax ≈ $3,060/year)

Tax Reduction Strategy:

- Use Roth conversions (convert IRA → Roth) in low-income years BEFORE claiming SS

- Roth conversions don’t count toward Combined Income

- You pay tax now but reduce future SS taxation

- Defer pension income if possible (stretch it across multiple years)

- Claim benefits at 70, not 62 (later claim = fewer years at risk for taxation)

- Use municipal bonds (interest is tax-exempt, doesn’t count toward C.I.)

Dollar Example: Paying $3,000/year in taxes on Social Security × 15 years = $45,000 lost. Strategic planning could reduce that to $0.

7. Claim Strategically as a Widow/Widower (Survivor Benefits)

If your spouse passed away, you may qualify for survivor benefits that are SEPARATE from your own Social Security benefit. Many widows/widowers claim too early and miss a 60-100% increase in benefits.

Survivor Benefit Amounts:

- At age 60: 71.5% of deceased spouse’s Primary Insurance Amount (PIA)

- At Full Retirement Age: 100% of deceased spouse’s PIA

- Before age 60: Only if you’re caring for a child under 16

The Strategy:

If your late spouse would have received $3,000/month at FRA, you could:

- Claim survivor benefit at 60: $2,145/month (71.5% of $3,000)

- Wait until 70: $3,600/month (100% + delayed credits; increases at your age)

Real Numbers:

- Claiming at 60 for 10 years: $257,400 total

- Waiting until 70: $432,000+ total (10+ years of payments)

- Difference: $174,600+ (and continues if you live past 80)

The Catch:

- If you remarry before age 60, survivor benefits are lost

- If you remarry after 60, you can keep the survivor benefit

- You can switch to your own Social Security at 62 (if it’s higher)

Pro Move: As a widow/widower, you have the option to claim survivor benefits early and let your own Social Security grow. This is one of the few remaining “file and suspend” strategies still available.

8. Leverage the Government Pension Offset (If Self-Employed)

If you receive a government pension (federal, state, or local), your spousal/survivor benefits might be reduced by the Windfall Elimination Provision (WEP). But strategic planning can minimize or eliminate this penalty.

What the WEP Does:

- Reduces your Social Security benefit by up to 50% if you have a government pension

- Only applies if your government work wasn’t covered by Social Security

Example:

- Your Social Security PIA (without WEP): $1,500/month

- Your government pension: $1,200/month

- WEP reduction: Up to 50% × $1,500 = -$750/month

- Actual benefit: $750/month (vs. full $1,500)

Workaround Strategies:

- Minimize years under government plan (some plans allow buy-outs)

- Work 30+ years in covered employment (WEP has a 30-year “fade out”)

- If 30 years of substantial earnings exist, WEP reduction drops significantly

- Claim spousal benefits before age 62 (if born before Jan 2, 1954; WEP may not apply)

Self-Employment Angle: If you’re self-employed AND worked under a government pension system, you might have negotiated options when those government positions end. Some advisors suggest timing your government job exit strategically to minimize WEP impact.

9. Increase Earnings in Your Highest-Earning Years

Social Security calculates your benefit on your highest 35 years of earnings. A $10,000 salary raise in your peak earning years can boost your benefit by $30-50/month permanently.

The Earnings Advantage:

- 2026 Social Security wage base: $184,500 (applies to tax withholding)

- Earnings above this limit don’t generate additional Social Security benefits

- Strategy: Maximize earnings in the 10 years BEFORE you claim

Real Example:

- Your best 35 years average: $52,000/year

- PIA (Primary Insurance Amount): $1,800/month

- If you increase average by $5,000/year: PIA increases to $1,968/month

- Lifetime gain (to 85): $40,320 more

How to Boost Earnings Before Claiming:

- Negotiate a raise (present data on your performance)

- Switch to a higher-paying role within your company or industry

- Take a side business/freelance work (counts as self-employment income after taxes)

- Delay retirement by 2-3 years if you’re earning more (automatically replaces lower years)

Important: The SSA only counts earnings SUBJECT to Social Security tax. So:

- W-2 wages: ✅ Fully counted

- Self-employment income: ✅ Counted (after 15.3% FICA self-employment tax)

- Rental income: ❌ NOT counted

- Investment gains: ❌ NOT counted

- Pension distributions: ❌ NOT counted

10. Suspend and Restart Your Benefits (If Born Before Jan 2, 1954)

If you were born before January 2, 1954, you have access to a “file and suspend” strategy. Claim early, then suspend benefits to let them grow, and restart at a higher amount later.

How It Works:

- Claim Social Security at 62 (get reduced benefit)

- At Full Retirement Age, formally “suspend” your benefits

- Benefits grow 8% per year until 70

- At 70, restart at the much higher amount

Example:

- Claim at 62: $1,500/month

- Suspend at 67: Stop receiving $1,500

- Restart at 70: $1,800/month (with 3 years of 8% credits)

- Plus: You received $1,500 × 60 months ($90,000) while suspended

The Modern Catch: If you were born January 2, 1954 or LATER, this strategy ended. The SSA eliminated it in 2015 to prevent high-income earners from gaming the system. If you were born later, claiming automatically locks in your age-based reduction permanently.

Who Qualifies:

- Born before January 2, 1954 ✅

- Can prove you were born exactly on Jan 2, 1954 ✅ (gray area; contact SSA)

- Born after January 2, 1954 ❌

Verification: Check your birth certificate or request an official birth record. This strategy is worth hundreds of thousands of dollars for qualified individuals.

11. Optimize Claiming Order in Multi-Child Families (Family Benefits)

Your minor children (under 19, or up to 23 if full-time student) can claim benefits on YOUR Social Security record. Each child gets benefits equal to up to 50% of your PIA, and the family maximum can reach 150-180% of your total benefit.

The Family Maximum Magic:

- Your PIA: $3,000/month

- Family maximum (typically 180% of your PIA): $5,400/month

- One spouse + 2 children could collectively receive $5,400

- Each person’s share is recalculated to fit the family max

Claiming Hierarchy:

- Your spouse at FRA: Up to 50% of your PIA

- Each child under 19: Up to 50% of your PIA

- Children aged 19-23 (full-time student): Same as minors

- Family cap applies not everyone gets the full 50%

Example:

- Your PIA: $2,400/month

- Spouse at FRA: 50% = $1,200/month

- Child 1 (age 10): 50% = $1,200/month

- Child 2 (age 14): 50% = $1,200/month

- Total requested: $3,600 vs. family max $4,320

- All three get their full share (under the family maximum)

Timing Note: Once a child turns 19 (or 23 if student), their benefit ends. If they’re in college, full-time enrollment must be maintained. No work restrictions apply they can earn unlimited money and still get benefits.

12. Claim Retirement Benefits at 62 If You Have Limited Life Expectancy

The mathematical “break-even” for claiming at 62 vs. 70 is around 80-82 years old. If health conditions or family history suggest you won’t reach that age, claiming early is the RIGHT financial move.

When Early Claiming Makes Sense:

- Life expectancy < 78 years (actuarial tables based on health)

- Diagnosed health condition (heart disease, cancer, diabetes complications)

- Family history of early mortality

- Limited savings; need income immediately

- Premium Social Security earnings (claim early, get $1,500+ monthly vs. waiting for $2,500)

The Math (All-In):

- Claim at 62: $1,500/month × 12 × 16 years (to 78) = $288,000 total

- Claim at 70: $2,500/month × 12 × 8 years (to 78) = $240,000 total

- Advantage to early claim: $48,000

Honest Reality Check: If you’ll likely live past 82-85 (strong genes, healthy lifestyle), waiting is mathematically superior. The longevity question is PERSONAL use family history, medical diagnosis, and actuarial calculators (ssa.gov/benefits/retirement/planner/agereduction.html) to decide.

The Psychological Angle: Many retirees claim at 62 because they value “bird in hand” having cash flow today beats future uncertainty. This is emotionally rational even if mathematically suboptimal.

13. Use Strategic Roth Conversions to Stay Below SS Tax Thresholds

Traditional IRA and 401(k) withdrawals count toward your “Combined Income,” triggering Social Security taxation. But Roth conversions (and subsequent Roth withdrawals) don’t count letting you reduce SS taxes by up to $5,000/year per household.

The Tax Arbitrage:

- Years 62-69 (before claiming SS): Convert IRAs to Roth at potentially low tax rates

- Years 70+ (after claiming SS): Withdraw from Roth TAX-FREE (doesn’t increase C.I.)

- Result: Same retirement spending, but lower Social Security taxation

Real Example:

- You’re age 63, not yet claiming SS

- Traditional IRA: $300,000

- Roth IRA: $50,000

- Income need: $40,000/year

Scenario A (No Conversion):

- Withdraw $40,000 from Traditional IRA

- At 70, claim SS ($2,500/month = $30,000/year)

- Combined Income: $40,000 + $15,000 (50% of SS) = $55,000

- SS taxation ≈ 85% × $30,000 = $25,500 taxable

Scenario B (With Conversion):

- Convert $40,000 from Trad IRA to Roth (pay ~$10,000 tax at your rate)

- Live off Roth withdrawals + small Traditional withdrawals

- At 70, claim SS ($2,500/month)

- Combined Income: $5,000 + $15,000 (50% of SS) = $20,000

- SS taxation ≈ 0% (below $44,000 threshold)

- Tax saved: $25,500 – $0 = $25,500 lifetime (vs. one-time $10,000 conversion cost)

The Catch: Roth conversions are taxable in the year you convert. You need flexibility in income/tax rate to make this work.

14. Appeal Denied or Incorrect Social Security Decisions (You Have Rights)

If SSA denies your claim or miscalculates your benefit, you have a formal appeal process. Many retirees accept the first “no” without fighting leaving tens of thousands on the table.

The Appeal Process (4 Steps):

Step 1: Reconsideration (within 60 days)

- File SSA Form SSA-561-U2

- Entirely new review by different SSA employee

- Success rate: ≈ 15% (low, but still worth trying)

Step 2: Administrative Hearing (3-6 months wait)

- Request a hearing before an Administrative Law Judge (ALJ)

- You can present evidence, witnesses, expert testimony

- Success rate: ≈ 60% (much higher)

- Recommended step: Hire a Social Security disability/benefits attorney

Step 3: Appeals Council Review (if ALJ denies)

- Panel of judges reviews the ALJ decision

- Success rate: ≈ 30%

- Rarely used, often skipped to federal court

Step 4: Federal Court Appeal

- File in federal district court

- Expensive (~$5,000 attorney fees) but possible if amount is large

Common Grounds for Appeal:

- Earnings record errors (as discussed in Tip #5)

- Incorrect benefit calculation

- Denied spousal benefits due to SSA error

- Incorrect Family Maximum applied

- Government Pension Offset (WEP) miscalculation

- Deemed filing rules applied incorrectly

Cost: Social Security attorneys work on contingency you pay only if you win, typically 25% of back benefits owed (capped at $6,000 as of 2024).

15. Final Bonus Tip: Use Spousal Benefits When One Spouse Didn’t Work

If one spouse was a homemaker/caregiver and never worked (or worked very little), they can still receive up to 50% of the working spouse’s benefit. This applies even if one spouse has ZERO work years.

Example:

- High-earning spouse: $2,800/month at FRA

- Non-working spouse (married 10+ years, at FRA): Eligible for 50% of $2,800 = $1,400/month

- Household total: $4,200/month vs. $2,800 solo

- Lifetime gain: $504,000 (to age 85)

Requirement: The receiving spouse must be:

- Age 62 or older (to claim spousal benefit)

- Married for at least 2 years (or 1 year if entitled to government benefits)

- Married to someone already claiming SS (or age 62+)

The Modern Catch: For those born after January 2, 1954, the automatic “deemed filing” rule applies you’re deemed to claim BOTH your own benefit AND spousal benefits simultaneously. The SSA will pay whichever is higher (typically your own benefit, not spousal).

This eliminates the old strategy where you’d claim spousal-only. However, if born BEFORE Jan 2, 1954, you can still claim spousal-only at FRA and let your own benefit grow to 70.

FREQUENTLY ASKED QUESTIONS

Q1: At what age should I claim Social Security to maximize lifetime benefits?

A: The answer depends on three factors: (1) Your health/life expectancy, (2) Your financial need, (3) Your marital status.

- If you’ll live past 80: Delay until 70 (8% annual increases = 76% total increase from FRA)

- If you’ll likely die before 80: Claim at 62 (break-even is typically 80-82)

- If married: The higher earner should delay to maximize spousal/survivor benefits

- If single with no dependents: Personal longevity is the only factor

The SSA calculator (ssa.gov) can give you personalized estimates for different claim ages.

Q2: Can I receive benefits from multiple ex-spouses?

A: YES, if you were married to each ex for at least 10 years AND are currently unmarried. You can claim spousal benefits from the HIGHEST ex-spouse, and potentially from others if the first benefit isn’t enough to reach the family maximum. However, SSA only pays the highest benefit you’re entitled to—not a combination. It’s strategic, not additive.

Q3: What’s the biggest Social Security mistake most people make?

A: Claiming too early without considering their spouse’s benefits. The average American claims at 62 and loses 30% of their benefit permanently. For married couples, this is often a mathematical disaster because:

- The higher earner should delay (increases survivor benefits for the spouse)

- The lower earner can claim spousal benefits at FRA without losing their own benefit growth (if born before 1954)

- A couple that coordinates claims can earn $100K+ more lifetime income vs. both claiming at 62

Q4: How much can I earn while claiming Social Security at 62?

A: In 2026, you can earn $23,400/year without losing benefits. For every $2 you earn above that limit, $1 is withheld from your Social Security benefit. Once you reach Full Retirement Age (within the claim year), the limit increases to $62,160, and the reduction is $1 for every $3 earned. After FRA, there’s NO earnings limit—work as much as you want.

Q5: Will Social Security run out of money before I claim?

A: No. The SSA has been operating at a deficit since 2021, with reserves expected to deplete around 2033-2035. However, even after reserves deplete, incoming payroll taxes (which fund ~80% of benefits) will allow the SSA to pay approximately 80% of scheduled benefits. Congress will likely increase payroll taxes or adjust benefits before a “shut down” occurs. If you’re claiming before 2033, you’re receiving 100% of scheduled benefits. After 2035, benefits may be reduced unless Congress acts.